Great Nicobar Island Transhipment Port: 11 Players Show Interest

11 companies have expressed interest in the Rs 41,000 crore international transhipment port project at Great Nicobar Island, India. The project aims to handle 16 million containers per year and is expected to be completed by 2028.

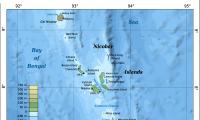

New Delhi, Jan 3 (PTI) The government has received expressions of interest (EOIs) from 11 players for the Rs 41,000-crore international transhipment port project at Great Nicobar Island in the Bay of Bengal, Union minister Sarbananda Sonowal said on Wednesday.

Last year, the Ministry of Ports, Shipping and Waterways in a statement said the project is expected to be completed with an investment of Rs 41,000 crore (USD 5 billion), including investment from both government and public-private partnership (PPP) concessionaires.

"11 players have submitted expressions of interest for the international transhipment port project at Great Nicobar Island," the ports, shipping and waterways minister said.

The EOI was sought on January 28, 2022.

The proposed port in the Andaman and Nicobar Islands will have the ultimate capacity to handle 16 million containers per year, and in the first phase, to be commissioned by 2028 at a cost of Rs 18,000 crore, it will handle more than 4 million containers.

Other projects planned around the transhipment port include an airport, a township and a power plant.

The project is located on the international trade route, with existing transhipment terminals like Singapore, Klang and Colombo in proximity.

The project focuses on three key drivers, which can result in making it a leading container transhipment port -- strategic location in terms of proximity (40 nautical miles) with the international shipping trade route, availability of natural water depth of over 20m and carrying capacity of transhipment cargo from all the ports in the proximity, including Indian ports, as per the statement.

The proposed facility is envisaged to be developed in four phases.

The estimated cost for Phase 1 of the proposed transhipment port is around Rs 18,000 crore, which includes the construction of breakwaters, dredging, reclamation, berths, storage areas, building and utilities, procurement and installation of equipment and development of the port colony, with core infrastructure going to be developed with the government support.

Public-private partnership (PPP) will be encouraged for this project via landlord mode. The PPP concessionaire will have the flexibility to develop a storage area, container handling equipment and other infrastructure based on the concessionaire's own market and business assessment, subject to the minimum guaranteed traffic.

The concessionaire would be awarded a long-term PPP concession of 30 to 50 years (based on requirement), will be responsible for the provision(s) of port services and shall have the rights to levy, collect and retain charges from port users.

Currently, nearly 75 per cent of India's transhipped cargo is handled at ports outside India.

Colombo, Singapore and Klang handle more than 85 per cent of this cargo, with more than half of it handled at Colombo port.

Last year, the Ministry of Ports, Shipping and Waterways in a statement said the project is expected to be completed with an investment of Rs 41,000 crore (USD 5 billion), including investment from both government and public-private partnership (PPP) concessionaires.

"11 players have submitted expressions of interest for the international transhipment port project at Great Nicobar Island," the ports, shipping and waterways minister said.

The EOI was sought on January 28, 2022.

The proposed port in the Andaman and Nicobar Islands will have the ultimate capacity to handle 16 million containers per year, and in the first phase, to be commissioned by 2028 at a cost of Rs 18,000 crore, it will handle more than 4 million containers.

Other projects planned around the transhipment port include an airport, a township and a power plant.

The project is located on the international trade route, with existing transhipment terminals like Singapore, Klang and Colombo in proximity.

The project focuses on three key drivers, which can result in making it a leading container transhipment port -- strategic location in terms of proximity (40 nautical miles) with the international shipping trade route, availability of natural water depth of over 20m and carrying capacity of transhipment cargo from all the ports in the proximity, including Indian ports, as per the statement.

The proposed facility is envisaged to be developed in four phases.

The estimated cost for Phase 1 of the proposed transhipment port is around Rs 18,000 crore, which includes the construction of breakwaters, dredging, reclamation, berths, storage areas, building and utilities, procurement and installation of equipment and development of the port colony, with core infrastructure going to be developed with the government support.

Public-private partnership (PPP) will be encouraged for this project via landlord mode. The PPP concessionaire will have the flexibility to develop a storage area, container handling equipment and other infrastructure based on the concessionaire's own market and business assessment, subject to the minimum guaranteed traffic.

The concessionaire would be awarded a long-term PPP concession of 30 to 50 years (based on requirement), will be responsible for the provision(s) of port services and shall have the rights to levy, collect and retain charges from port users.

Currently, nearly 75 per cent of India's transhipped cargo is handled at ports outside India.

Colombo, Singapore and Klang handle more than 85 per cent of this cargo, with more than half of it handled at Colombo port.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005