Groww Adds 1 Million New Mutual Fund SIPs in December

By Rediff Money Desk, NEWDELHI Feb 07, 2024 16:06

Groww, a fintech platform, saw over 1 million new SIPs in December, making it the top distributor of mutual funds in India. The company attributes the surge to increased financial awareness and investors' preference for direct funds.

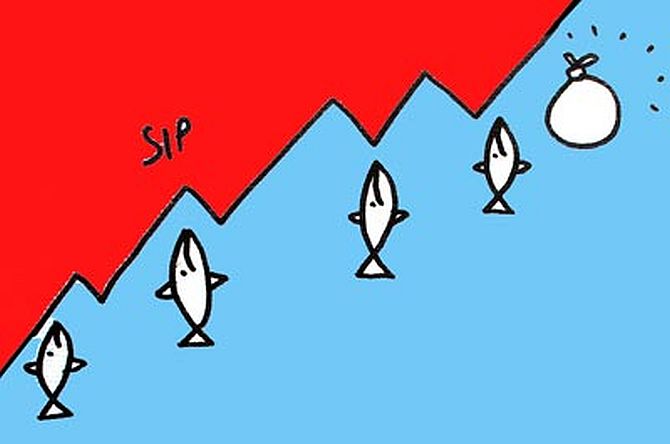

Illustration: Dominic Xavier/Rediff.com

New Delhi, Feb 7 (PTI) Fintech platform Groww has emerged as the top distributor of mutual funds with the addition of over 1 million new SIPs (Systematic Investment Plans) in December, accounting for 25 per cent of total new SIPs in the country.

According to data from Association of Mutual Fund Industry (Amfi), the number of SIP accounts touched 7.63 crore, out of which, 40.3 lakh new SIP accounts were added in December, the highest-ever recorded in a month.

Of the 40.3 lakh addition in December, over 10 lakh of these new SIPs were opened on Groww by retail investors across the country. Further, there were about 3.5 crore new SIPs by the industry in the 2023 and Groww contributed to 20 per cent of the new addition, the company said.

"The recent surge in SIPs validates that the new investors are responsible and prudent. India has seen over 50 per cent year-on-year growth in new SIPs while on Groww it has doubled in the last 12 months," Harsh Jain, Co-founder and COO, Groww, said.

The industry saw SIP contributions have been consistently rising on a month-on-month basis and hit an all-time high of Rs 17,610 crore in December from Rs 17,073 crore in November.

Investors are placing significant bets on SIPs, with inflows rising to Rs 1.8 lakh crore in 2023.

Industry insiders believe that SIPs have gained traction among Indian retail investors owing to their structured and enduring investment approach. Besides, there has also been a paradigm shift in Indian society, as more and more people now prefer to take control of their finances rather than rely on a middleman for their mutual fund investments.

Additionally, increased interest in financial awareness and education has empowered investors to make informed decisions. Further, retail investors are also more aware of the benefits of direct mutual funds, over regular funds as direct funds help save commission fees, which can be significant for long-term investors, they added.

SIP is an investment methodology offered by mutual funds wherein an individual can invest a fixed amount in a chosen scheme periodically at fixed intervals -- say once a month, instead of making a lumpsum investment. At present, SIP installment amount can be as small as Rs 500 per month.

Founded in 2016 by Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal, Groww allows users to invest in Mutual Funds, Stocks, ETFs, etc. The firm recently launched payments and credit on the platform. Also, it ventured into asset management with Groww Mutual Fund after acquiring Indiabulls AMC.

The Fintech firm serves more than 7.6 active clients as per NSE and on an average has been accounting for more than 7 lakh new SIPs every month.

Further, it posted profits of Rs 448.7 crore and revenues of Rs 1,277 crores in the financial year (FY23).

According to data from Association of Mutual Fund Industry (Amfi), the number of SIP accounts touched 7.63 crore, out of which, 40.3 lakh new SIP accounts were added in December, the highest-ever recorded in a month.

Of the 40.3 lakh addition in December, over 10 lakh of these new SIPs were opened on Groww by retail investors across the country. Further, there were about 3.5 crore new SIPs by the industry in the 2023 and Groww contributed to 20 per cent of the new addition, the company said.

"The recent surge in SIPs validates that the new investors are responsible and prudent. India has seen over 50 per cent year-on-year growth in new SIPs while on Groww it has doubled in the last 12 months," Harsh Jain, Co-founder and COO, Groww, said.

The industry saw SIP contributions have been consistently rising on a month-on-month basis and hit an all-time high of Rs 17,610 crore in December from Rs 17,073 crore in November.

Investors are placing significant bets on SIPs, with inflows rising to Rs 1.8 lakh crore in 2023.

Industry insiders believe that SIPs have gained traction among Indian retail investors owing to their structured and enduring investment approach. Besides, there has also been a paradigm shift in Indian society, as more and more people now prefer to take control of their finances rather than rely on a middleman for their mutual fund investments.

Additionally, increased interest in financial awareness and education has empowered investors to make informed decisions. Further, retail investors are also more aware of the benefits of direct mutual funds, over regular funds as direct funds help save commission fees, which can be significant for long-term investors, they added.

SIP is an investment methodology offered by mutual funds wherein an individual can invest a fixed amount in a chosen scheme periodically at fixed intervals -- say once a month, instead of making a lumpsum investment. At present, SIP installment amount can be as small as Rs 500 per month.

Founded in 2016 by Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal, Groww allows users to invest in Mutual Funds, Stocks, ETFs, etc. The firm recently launched payments and credit on the platform. Also, it ventured into asset management with Groww Mutual Fund after acquiring Indiabulls AMC.

The Fintech firm serves more than 7.6 active clients as per NSE and on an average has been accounting for more than 7 lakh new SIPs every month.

Further, it posted profits of Rs 448.7 crore and revenues of Rs 1,277 crores in the financial year (FY23).

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.93 ( -4.87)

- 226206286

- IFL Enterprises

- 1.30 (+ 4.84)

- 81461564

- Vodafone Idea L

- 16.79 (+ 0.66)

- 67447398

- NCL Research

- 0.95 ( -4.04)

- 31996628

- Franklin Industries

- 3.73 (+ 3.32)

- 21511209

MORE NEWS

Navi Mumbai Airport ILS Signal Testing Begins

The Airports Authority of India (AAI) has begun ILS signal testing at the...

Air India VRS for Non-Flying Staff Ahead of...

Air India has announced a voluntary retirement scheme (VRS) and voluntary separation...

Fisher Groups Oppose WTO Fisheries Subsidy Talks

Small-scale fisher groups from India, Indonesia, and Bangladesh demand WTO keep...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.