GST Revenue Rises 12.5% to ₹1.68 Lakh Cr in Feb

GST collections in February 2024 surged 12.5% to ₹1.68 lakh crore, marking the fourth-highest monthly revenue since its implementation. This growth reflects robust domestic sales and imports.

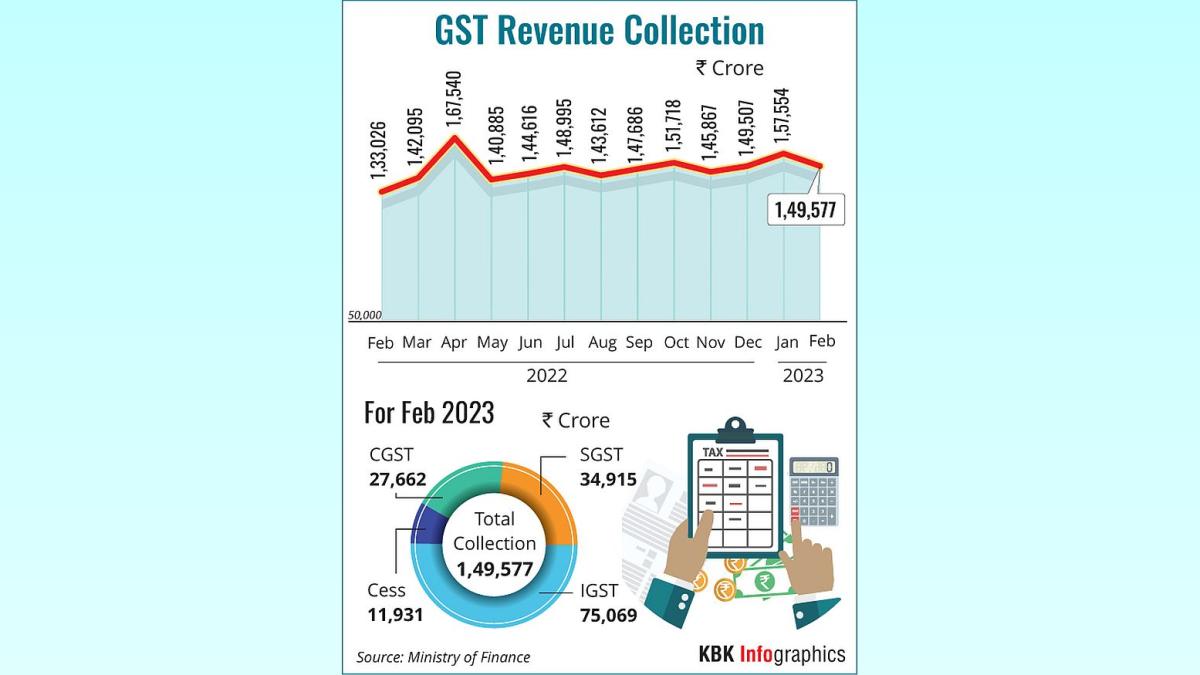

Illustration: Dominic Xavier/Rediff.com

New Delhi, Mar 1 (PTI) GST collections rose by 12.5 per cent to Rs 1.68 lakh crore in February 2024 compared to the year-ago period buoyed by an increase in domestic sales as well as imports.

With this, the gross GST collection in April-February of the current fiscal stood at Rs 18.40 lakh crore, up by 11.7 per cent year-on-year.

"Gross Goods and Services Tax (GST) revenue collected for February 2024 is Rs 1,68,337 crore, marking a robust 12.5 per cent increase compared to that in the same month in 2023. This growth was driven by a 13.9 per cent rise in GST from domestic transactions and 8.5 per cent increase in GST from import of goods," a finance ministry statement said.

The average monthly collections in the current fiscal stood at Rs 1.67 lakh crore, higher than Rs 1.5 lakh crore in the previous fiscal.

GST revenue net of refunds for February 2024 is Rs 1.51 lakh crore, a growth of 13.6 per cent over February 2023.

The central government settled Rs 41,856 crore to Central GST and Rs 35,953 crore to State GST from the Integrated GST collected. This translates to a total revenue of Rs 73,641 crore for CGST and Rs 75,569 crore for SGST after regular settlement in February.

The highest-ever GST collection was recorded at Rs 1.87 lakh crore in April 2023, followed by Rs 1.74 lakh crore in January 2024, and Rs 1.72 lakh crore in October 2023. In February 2024, the collections came in at Rs 1.68 lakh crore, the fourth-highest monthly collections so far.

Deloitte India Partner M S Mani said coming on the back of the robust GDP numbers for the third quarter, the impressive GST collection is reflecting the broad-based consumption increase across sectors.

"Almost all major states have shown an impressive increase in GST collections ranging from 8 to 21 per cent demonstrating that the consumption growth is across states as GST is a destination-based consumption tax, Mani added.

KPMG in India Partner and National Head, Indirect Tax Abhishek Jain said the GDP growth and GST revenue numbers collectively show the robustness of the Indian economy and domestic consumption story going strong.

N.A. Shah Associates, Partner, Indirect Tax, Parag Mehta, said the collection is proof of Indian economy moving towards all-time high.

"GST has stabilized. Strict compliance by trade, dealing only with registered and law-compliant vendors, has been a major reason for increasing turnover. Besides the authorities have been very vigilant and sharing of information between various government departments has ensured control and strict action against tax evaders," Mehta said.

With this, the gross GST collection in April-February of the current fiscal stood at Rs 18.40 lakh crore, up by 11.7 per cent year-on-year.

"Gross Goods and Services Tax (GST) revenue collected for February 2024 is Rs 1,68,337 crore, marking a robust 12.5 per cent increase compared to that in the same month in 2023. This growth was driven by a 13.9 per cent rise in GST from domestic transactions and 8.5 per cent increase in GST from import of goods," a finance ministry statement said.

The average monthly collections in the current fiscal stood at Rs 1.67 lakh crore, higher than Rs 1.5 lakh crore in the previous fiscal.

GST revenue net of refunds for February 2024 is Rs 1.51 lakh crore, a growth of 13.6 per cent over February 2023.

The central government settled Rs 41,856 crore to Central GST and Rs 35,953 crore to State GST from the Integrated GST collected. This translates to a total revenue of Rs 73,641 crore for CGST and Rs 75,569 crore for SGST after regular settlement in February.

The highest-ever GST collection was recorded at Rs 1.87 lakh crore in April 2023, followed by Rs 1.74 lakh crore in January 2024, and Rs 1.72 lakh crore in October 2023. In February 2024, the collections came in at Rs 1.68 lakh crore, the fourth-highest monthly collections so far.

Deloitte India Partner M S Mani said coming on the back of the robust GDP numbers for the third quarter, the impressive GST collection is reflecting the broad-based consumption increase across sectors.

"Almost all major states have shown an impressive increase in GST collections ranging from 8 to 21 per cent demonstrating that the consumption growth is across states as GST is a destination-based consumption tax, Mani added.

KPMG in India Partner and National Head, Indirect Tax Abhishek Jain said the GDP growth and GST revenue numbers collectively show the robustness of the Indian economy and domestic consumption story going strong.

N.A. Shah Associates, Partner, Indirect Tax, Parag Mehta, said the collection is proof of Indian economy moving towards all-time high.

"GST has stabilized. Strict compliance by trade, dealing only with registered and law-compliant vendors, has been a major reason for increasing turnover. Besides the authorities have been very vigilant and sharing of information between various government departments has ensured control and strict action against tax evaders," Mehta said.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005