Hexaware Tech IPO Fully Subscribed: QIBs Drive Demand

Hexaware Technologies IPO gets fully subscribed on the last day with strong support from Qualified Institutional Buyers (QIBs). The Rs 8,750 crore offer received 2.66 times subscription.

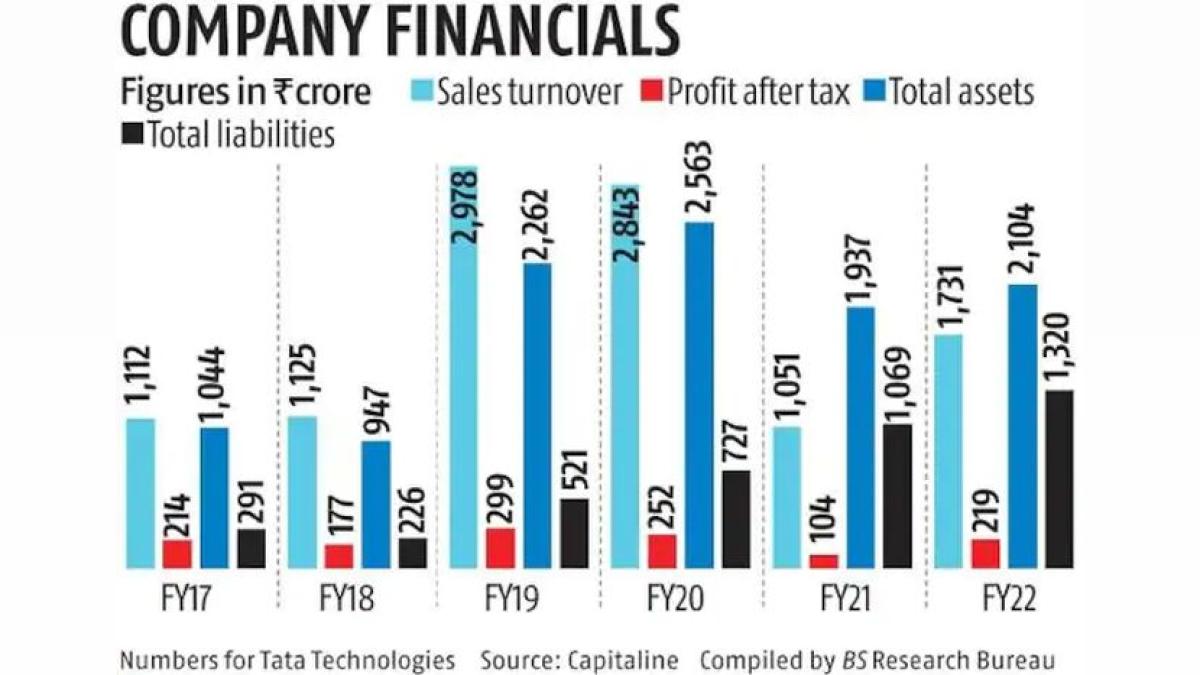

Photograph: Kind courtesy Tata Technologies/Facebook

New Delhi, Feb 14 (PTI) The initial public offer of Hexaware Technologies Ltd got fully subscribed on the last day of bidding, ending the day with 2.66 times subscription, on institutional buyers support.

The three-day Rs 8,750-crore initial share sale received bids for 24,28,44,315 shares against 9,14,23,354 shares on offer, according to data available with the NSE.

The portion for Qualified Institutional Buyers (QIBs) fetched 9.09 times subscription. Non-Institutional Investors part received 20 per cent subscription while the quota for Retail Individual Investors (RIIs) got subscribed 11 per cent.

Hexaware Technologies Ltd has mopped up Rs 2,598 crore from anchor investors.

The company has set a price band at Rs 674-708 per share for the Initial Public Offering (IPO).

At the upper end of the price band, the company has been valued at over Rs 43,000 crore.

The initial share sale of the Mumbai-headquartered company is a complete Offer for Sale (OFS) of equity shares worth Rs 8,750 crore by promoter CA Magnum Holdings, part of Carlyle Group.

Since the entire issue is an OFS, all the proceeds from the IPO will go directly to the selling shareholder, rather than the company.

Hexaware's public issue is the largest in the country's IT services sector since Tata Consultancy Services' over Rs 4,700 crore IPO over two decades ago.

Hexaware Technologies is a global digital and technology services company.

Kotak Mahindra Capital Company Ltd, Citigroup Global Markets India Private Ltd, JP Morgan India Private Ltd, HSBC Securities and Capital Markets (India) Private Ltd and IIFL Capital Services Ltd are the book-running lead managers to the issue.

The equity shares will be listed on BSE and NSE.

The three-day Rs 8,750-crore initial share sale received bids for 24,28,44,315 shares against 9,14,23,354 shares on offer, according to data available with the NSE.

The portion for Qualified Institutional Buyers (QIBs) fetched 9.09 times subscription. Non-Institutional Investors part received 20 per cent subscription while the quota for Retail Individual Investors (RIIs) got subscribed 11 per cent.

Hexaware Technologies Ltd has mopped up Rs 2,598 crore from anchor investors.

The company has set a price band at Rs 674-708 per share for the Initial Public Offering (IPO).

At the upper end of the price band, the company has been valued at over Rs 43,000 crore.

The initial share sale of the Mumbai-headquartered company is a complete Offer for Sale (OFS) of equity shares worth Rs 8,750 crore by promoter CA Magnum Holdings, part of Carlyle Group.

Since the entire issue is an OFS, all the proceeds from the IPO will go directly to the selling shareholder, rather than the company.

Hexaware's public issue is the largest in the country's IT services sector since Tata Consultancy Services' over Rs 4,700 crore IPO over two decades ago.

Hexaware Technologies is a global digital and technology services company.

Kotak Mahindra Capital Company Ltd, Citigroup Global Markets India Private Ltd, JP Morgan India Private Ltd, HSBC Securities and Capital Markets (India) Private Ltd and IIFL Capital Services Ltd are the book-running lead managers to the issue.

The equity shares will be listed on BSE and NSE.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- AvanceTechnologies

- 1.17 ( -4.88)

- 88887803

- Vodafone-Idea-L

- 10.73 ( 0.00)

- 41759699

- Alstone-Textiles

- 0.30 ( -3.23)

- 38604790

- Meesho-L

- 170.20 (+ 53.33)

- 33021643

- Spicejet-Ltd

- 33.88 ( -1.25)

- 28519832