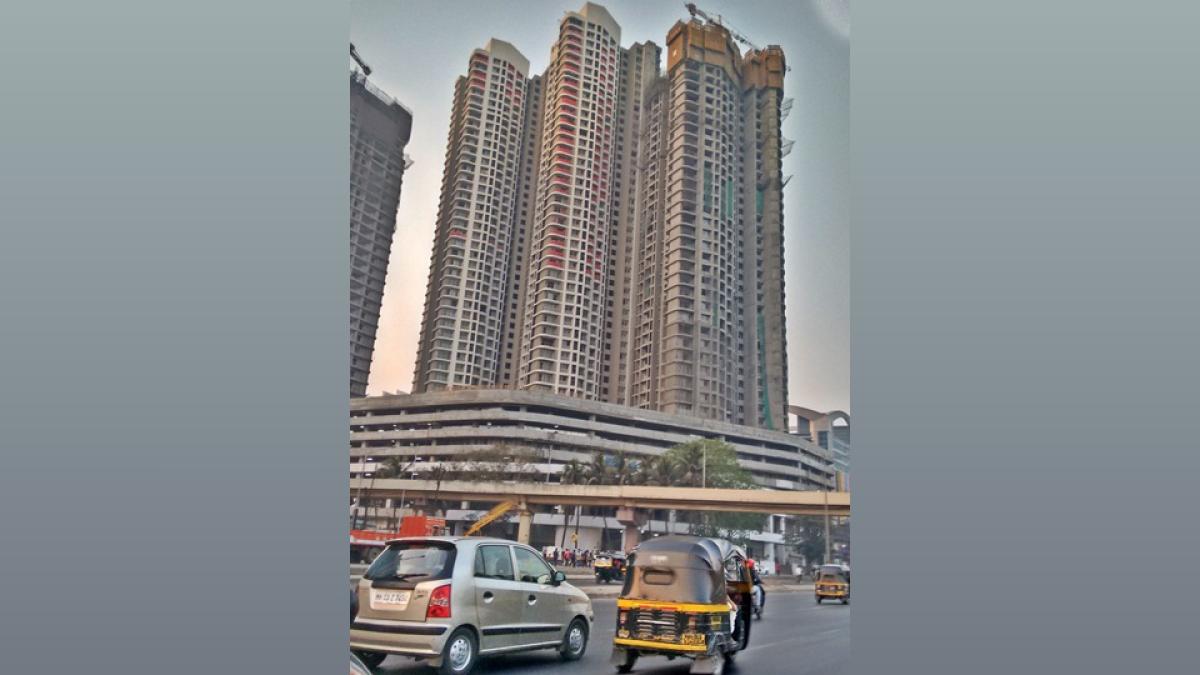

HoABL Enters Vertical Segment, Aims 50% Revenue in 3 Years

x

House of Abhinandan Lodha (HoABL) enters the vertical segment, targeting 50% revenue from multi-storey residential and commercial projects in 3 years.

Mumbai, Apr 23 (PTI) Days after reaching a family truce, House of Abhinandan Lodha on Wednesday announced an entry into the vertical segment, involving construction of multi-storey residential and commercial properties.

Abhinandan Lodha, the younger of the Lodha siblings, said HoABL is targeting 50 per cent of revenues to come from the vertical segment in the next two-three years.

The company is entering the 'vertical' segment with a Rs 2,500-crore investment commitment in three developments in the Mumbai megapolis over the next few years, which have a gross development value of Rs 3,500-crore, he told reporters.

The Lodha siblings -- elder brother Abhishek runs the much bigger Macrotech Developers -- reached a truce after weeks of negotiations on April 14, under which HoABL has assured not to use the 'Lodha' brand name. HoABL has been so far engaged in horizontal development, or developing land for bungalows or villas.

Abhinandan Lodha, the chairman of HoABL, said there is no bearing of the family truce on the announcement, pointing out that it is being done after bagging the requisite proposals for one of the projects.

A non-compete pact which prevented him from undertaking any development in Mumbai ended in 2022 and he is now free to operate by himself.

The three projects announced on Wednesday include turning the former American Culture Centre in south Mumbai's Marine Lines into a 60,000 sq ft commercial development, a plot abutting the sea with a 50,000sq ft potential and a township in the faraway suburb of Naigaon north of the financial capital which has a 30 lakh sq ft potential.

Abhinandan Lodha said 5 per cent of the company's 1,200-acre land bank is fit for vertical development, and added that it is aggressively looking to add land parcels which could house multistory buildings.

Much of the funding for the new developments will be through internal accruals from the horizontal development, and pre-booking sums, he said, adding that it will raise debt of only up to Rs 300 crore.

The horizontal business will continue to grow at 30 per cent as targeted earlier, but the vertical one will grow faster to occupy a 50 per cent share in the revenue in the next two-three years, he said.

There is no need for capital from external sources for the company at present, he said, pointing that it may do some equity shares on a project level.

Construction work on the three projects will start by December this year, and HoABL is aiming to have vertical development in Amritsar, Nagpur and Vrindavan as well, he said, adding that there is large scope for the segment.

Abhinandan Lodha, the younger of the Lodha siblings, said HoABL is targeting 50 per cent of revenues to come from the vertical segment in the next two-three years.

The company is entering the 'vertical' segment with a Rs 2,500-crore investment commitment in three developments in the Mumbai megapolis over the next few years, which have a gross development value of Rs 3,500-crore, he told reporters.

The Lodha siblings -- elder brother Abhishek runs the much bigger Macrotech Developers -- reached a truce after weeks of negotiations on April 14, under which HoABL has assured not to use the 'Lodha' brand name. HoABL has been so far engaged in horizontal development, or developing land for bungalows or villas.

Abhinandan Lodha, the chairman of HoABL, said there is no bearing of the family truce on the announcement, pointing out that it is being done after bagging the requisite proposals for one of the projects.

A non-compete pact which prevented him from undertaking any development in Mumbai ended in 2022 and he is now free to operate by himself.

The three projects announced on Wednesday include turning the former American Culture Centre in south Mumbai's Marine Lines into a 60,000 sq ft commercial development, a plot abutting the sea with a 50,000sq ft potential and a township in the faraway suburb of Naigaon north of the financial capital which has a 30 lakh sq ft potential.

Abhinandan Lodha said 5 per cent of the company's 1,200-acre land bank is fit for vertical development, and added that it is aggressively looking to add land parcels which could house multistory buildings.

Much of the funding for the new developments will be through internal accruals from the horizontal development, and pre-booking sums, he said, adding that it will raise debt of only up to Rs 300 crore.

The horizontal business will continue to grow at 30 per cent as targeted earlier, but the vertical one will grow faster to occupy a 50 per cent share in the revenue in the next two-three years, he said.

There is no need for capital from external sources for the company at present, he said, pointing that it may do some equity shares on a project level.

Construction work on the three projects will start by December this year, and HoABL is aiming to have vertical development in Amritsar, Nagpur and Vrindavan as well, he said, adding that there is large scope for the segment.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.72 (+ 0.60)

- 37644067

- Spright-Agro

- 0.77 ( -4.94)

- 15463242

- Harshil-Agrotech

- 0.63 (+ 3.28)

- 13782857

- Mehai-Technology

- 1.65 ( -4.62)

- 9809507

- AvanceTechnologies

- 1.06 ( -4.50)

- 7191910