India Cuts Windfall Tax on Crude Oil to Rs 1,850/tonne

By Rediff Money Desk, New Delhi Aug 31, 2024 11:28

India has reduced the windfall tax on domestically-produced crude oil to Rs 1,850 per tonne, effective from August 31, 2024. The tax, levied as Special Additional Excise Duty, was previously Rs 2,100 per tonne.

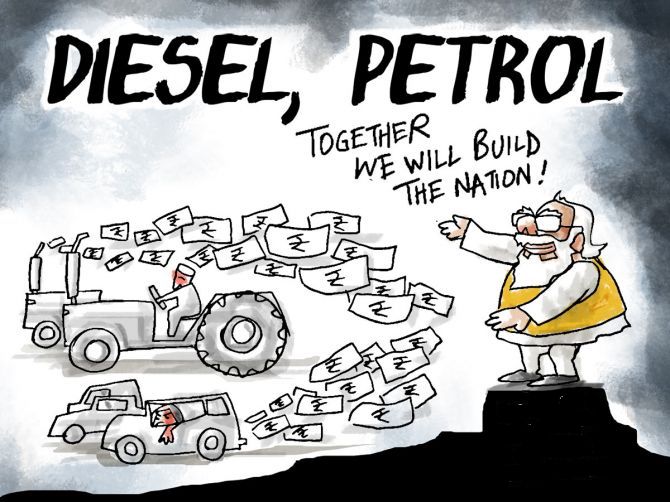

Illustration: Dominic Xavier/Rediff.com

New Delhi, Aug 31 (PTI) The government has cut windfall tax on domestically-produced crude oil to Rs 1,850 per tonne, from Rs 2,100 per tonne with effect from Saturday.

The tax is levied in the form of Special Additional Excise Duty (SAED). The SAED on the export of diesel, petrol and jet fuel or ATF, has been retained at nil'.

The new rates are effective from August 31, 2024, an official notification issued late Friday said.

India first imposed windfall profit taxes on July 1, 2022, joining a host of nations that tax supernormal profits of energy companies. The tax rates are reviewed every fortnight based on average oil prices in the previous two weeks.

The tax is levied in the form of Special Additional Excise Duty (SAED). The SAED on the export of diesel, petrol and jet fuel or ATF, has been retained at nil'.

The new rates are effective from August 31, 2024, an official notification issued late Friday said.

India first imposed windfall profit taxes on July 1, 2022, joining a host of nations that tax supernormal profits of energy companies. The tax rates are reviewed every fortnight based on average oil prices in the previous two weeks.

Source: PTI

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone Idea L

- 15.63 ( -4.17)

- 51716103

- Srestha Finvest

- 1.94 ( -1.02)

- 39556969

- Inventure Growth & S

- 2.47 ( -19.81)

- 31916723

- Genpharmasec Ltd

- 3.51 ( -4.88)

- 21009955

- GTL Infrastructure

- 2.68 ( -0.37)

- 16825789

MORE NEWS

Pakistan Economy Stabilizing: PM Shehbaz Sharif

Pakistani Prime Minister Shehbaz Sharif announced the economy is moving towards...

Royal Enfield Sales Dip 5% in August - PTI

Royal Enfield reported a 5% decline in total sales in August, with domestic sales...

Hero MotoCorp Sales Rise 5% in August:...

Hero MotoCorp's August wholesales climbed 5% year-on-year to 5,12,360 units, driven by...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.