India IPOs: Busiest Month in 14 Years | RBI Bulletin

By Rediff Money Desk, Mumbai Sep 20, 2024 20:15

September is set to be the busiest month for IPOs in India in 14 years, with over 28 companies entering the market, according to the latest RBI Bulletin.

Illustration: Dominic Xavier/Rediff.com

Mumbai, Sep 20 (PTI) The month of September is set to be the busiest month for IPOs in both mainboard and SME segments in the last 14 years, with over 28 companies entering the market so far, said the Reserve Bank's latest Bulletin released on Friday.

Financial markets are undergoing shifts, said the article on the state of economy published in the RBI's September Bulletin.

"In the primary equity market, there is a surge of interest in small and medium enterprises (SMEs) initial public offerings (IPOs), including from domestic mutual funds, with massive oversubscriptions," it said.

Citing a study by market regulator SEBI, the article further said 54 per cent of IPO shares allotted to investors were sold within a week of listing.

"September is set to be the busiest month for IPOs... in 14 years," the article said, adding that over 28 companies entered the market so far in both mainboard and SME platforms.

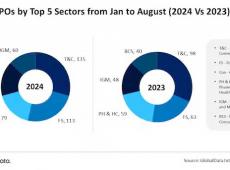

The article said resource mobilisation through initial public offerings (IPOs) has remained robust in 2024 so far, as India accounted for the highest number of IPOs globally (27 per cent by volume) in the first half of 2024, led by public offerings of small and medium enterprises (SMEs).

In terms of the amount raised, India accounted for 9 per cent of total proceeds raised through IPOs, it said.

"Investor enthusiasm in the primary segment can be gauged by the fact that the IPO of a housing finance company in the second week of September garnered bids of over Rs 3 lakh crore," it said.

The article further said a growing number of listed companies are turning to qualified institutional placements for raising capital, estimated at around Rs 60,000 crore in the first eight months of 2024.

"With intermittent corrections on global cues, benchmark indices in the secondary market have moved up, and the outlook remains bullish," it said.

The article authored by a team lead by RBI Deputy Governor Michael Debabrata Patra also said global funds have been investing heavily in the Indian debt market for the fifth month in a row since May 2024.

"On the other hand, corporate debt issuances remained low during the financial year so far despite easing yields as issuers awaited the US rate cut," it said.

Financial markets are undergoing shifts, said the article on the state of economy published in the RBI's September Bulletin.

"In the primary equity market, there is a surge of interest in small and medium enterprises (SMEs) initial public offerings (IPOs), including from domestic mutual funds, with massive oversubscriptions," it said.

Citing a study by market regulator SEBI, the article further said 54 per cent of IPO shares allotted to investors were sold within a week of listing.

"September is set to be the busiest month for IPOs... in 14 years," the article said, adding that over 28 companies entered the market so far in both mainboard and SME platforms.

The article said resource mobilisation through initial public offerings (IPOs) has remained robust in 2024 so far, as India accounted for the highest number of IPOs globally (27 per cent by volume) in the first half of 2024, led by public offerings of small and medium enterprises (SMEs).

In terms of the amount raised, India accounted for 9 per cent of total proceeds raised through IPOs, it said.

"Investor enthusiasm in the primary segment can be gauged by the fact that the IPO of a housing finance company in the second week of September garnered bids of over Rs 3 lakh crore," it said.

The article further said a growing number of listed companies are turning to qualified institutional placements for raising capital, estimated at around Rs 60,000 crore in the first eight months of 2024.

"With intermittent corrections on global cues, benchmark indices in the secondary market have moved up, and the outlook remains bullish," it said.

The article authored by a team lead by RBI Deputy Governor Michael Debabrata Patra also said global funds have been investing heavily in the Indian debt market for the fifth month in a row since May 2024.

"On the other hand, corporate debt issuances remained low during the financial year so far despite easing yields as issuers awaited the US rate cut," it said.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Srestha Finvest

- 0.66 (+ 4.76)

- 32896927

- Vodafone Idea L

- 8.45 (+ 4.06)

- 28557277

- Standard Capital

- 1.14 (+ 0.88)

- 17361276

- Alstone Textiles

- 0.83 (+ 5.06)

- 14796552

- AvanceTechnologies

- 0.89 (+ 4.71)

- 10049569

MORE NEWS

India Commits to Sendai Framework for Disaster...

India reaffirms its commitment to the Sendai Framework for disaster risk reduction,...

Hero MotoCorp Sales Surge 18% in October

Hero MotoCorp's sales rose by 18% in October, reaching 6.8 lakh units. Strong demand...

Gold, Silver Jewelry Export Norms Revised:...

The Indian government has revised norms for gold, silver, and platinum jewelry exports,...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.