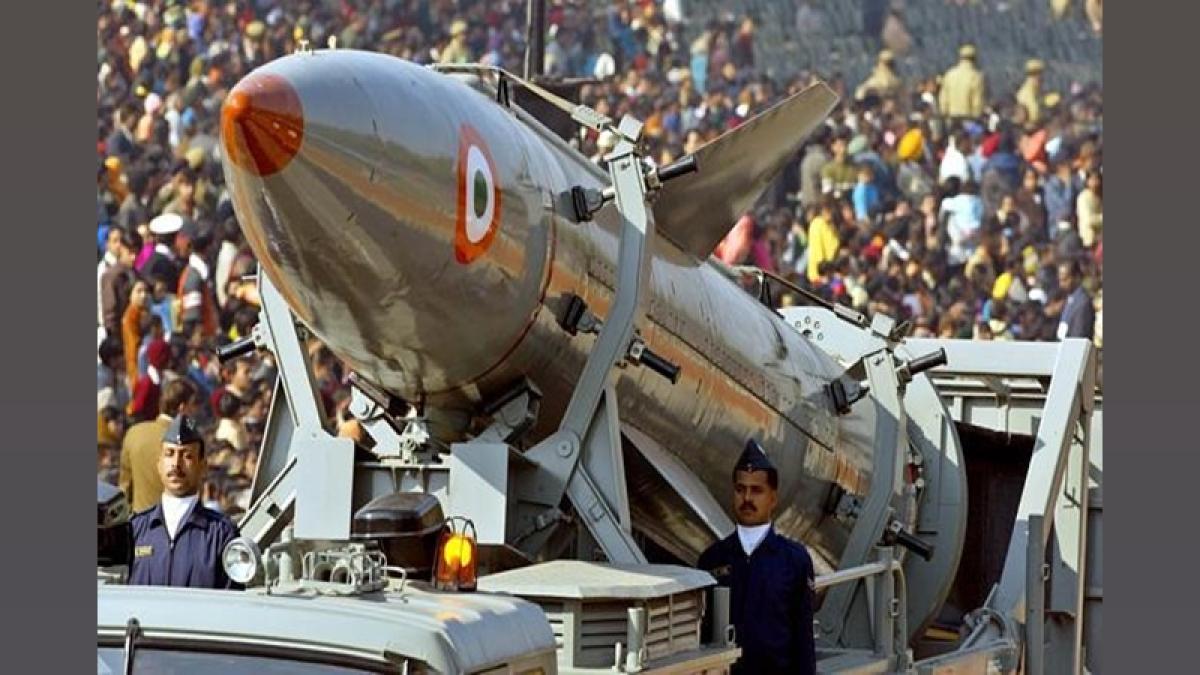

India's Defence Budget: EY Recommends 3% GDP Allocation

x

EY report suggests India benchmark military spending at 3% of GDP, create a non-lapsable modernisation fund, and boost domestic manufacturing for stronger defence.

New Delhi, Jun 30 (PTI) India should consider benchmarking military spending at 3 per cent of GDP, creating a non-lapsable defence modernisation fund, besides incentivising domestic manufacturing, an EY report said on Monday.

The June edition of EY Economy Watch highlighted the need for a forward-looking defence budgeting strategy, saying this would build a more resilient and responsive defence infrastructure, and make India better equipped to address evolving geopolitical and technological challenges.

"Over the years, India's military expenditure as a share of GDP has gradually declined - from close to 3 per cent in the early 2000s to just over 2 per cent today, whereas countries like the US and Russia continue to allocate significantly higher proportions," it said.

The EY report recommended "benchmarking defence allocations at 3 per cent of GDP, supplemented by the creation of a non-lapsable defence modernisation fund, and incentivising domestic manufacturing to unlock long-term economic growth multipliers".

Going forward, there is a need to enhance the capital component of the defence budget, streamline procurement processes, and emphasise defence-related research and development.

EY India Chief Policy Advisor, D K Srivastava, said, "Benchmarking defence spending at 3 per cent of GDP and operationalising a dedicated non-lapsable modernisation fund can provide the fiscal predictability required for investing in advanced technology, strengthening domestic defence manufacturing ecosystems, and driving innovation-led procurement."

The 15th Finance Commission had proposed the creation of a Modernisation Fund for Defence and Internal Security (MFDIS), a non-lapsable corpus under the Public Account of India, to be financed through disinvestment proceeds, monetisation of surplus defence land, and voluntary contributions.

"Although accepted in principle by the government, this fund is yet to be implemented. Reviving the proposal could provide consistent capital support, insulating critical defence investments from year-to-year fluctuations," the EY Economy Watch report said.

The June edition of EY Economy Watch highlighted the need for a forward-looking defence budgeting strategy, saying this would build a more resilient and responsive defence infrastructure, and make India better equipped to address evolving geopolitical and technological challenges.

"Over the years, India's military expenditure as a share of GDP has gradually declined - from close to 3 per cent in the early 2000s to just over 2 per cent today, whereas countries like the US and Russia continue to allocate significantly higher proportions," it said.

The EY report recommended "benchmarking defence allocations at 3 per cent of GDP, supplemented by the creation of a non-lapsable defence modernisation fund, and incentivising domestic manufacturing to unlock long-term economic growth multipliers".

Going forward, there is a need to enhance the capital component of the defence budget, streamline procurement processes, and emphasise defence-related research and development.

EY India Chief Policy Advisor, D K Srivastava, said, "Benchmarking defence spending at 3 per cent of GDP and operationalising a dedicated non-lapsable modernisation fund can provide the fiscal predictability required for investing in advanced technology, strengthening domestic defence manufacturing ecosystems, and driving innovation-led procurement."

The 15th Finance Commission had proposed the creation of a Modernisation Fund for Defence and Internal Security (MFDIS), a non-lapsable corpus under the Public Account of India, to be financed through disinvestment proceeds, monetisation of surplus defence land, and voluntary contributions.

"Although accepted in principle by the government, this fund is yet to be implemented. Reviving the proposal could provide consistent capital support, insulating critical defence investments from year-to-year fluctuations," the EY Economy Watch report said.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea

- 11.25 ( -0.97)

- 50470875

- Shish-Industries

- 9.06 ( -7.93)

- 48510445

- Sylph-Technologies

- 1.05 (+ 8.25)

- 31188449

- Welcure-Drugs-and

- 0.46 ( -4.17)

- 28881487

- Sunshine-Capital

- 0.27 (+ 3.85)

- 14394299