India's General Govt Debt to Stabilize Above 80% of GDP: Moody's

Moody's projects India's general government debt to stabilize above 80% of GDP over the next three years, down from 89.3% in 2020-21. The rating agency expects interest payments to fall to 24% of revenue in the next two years.

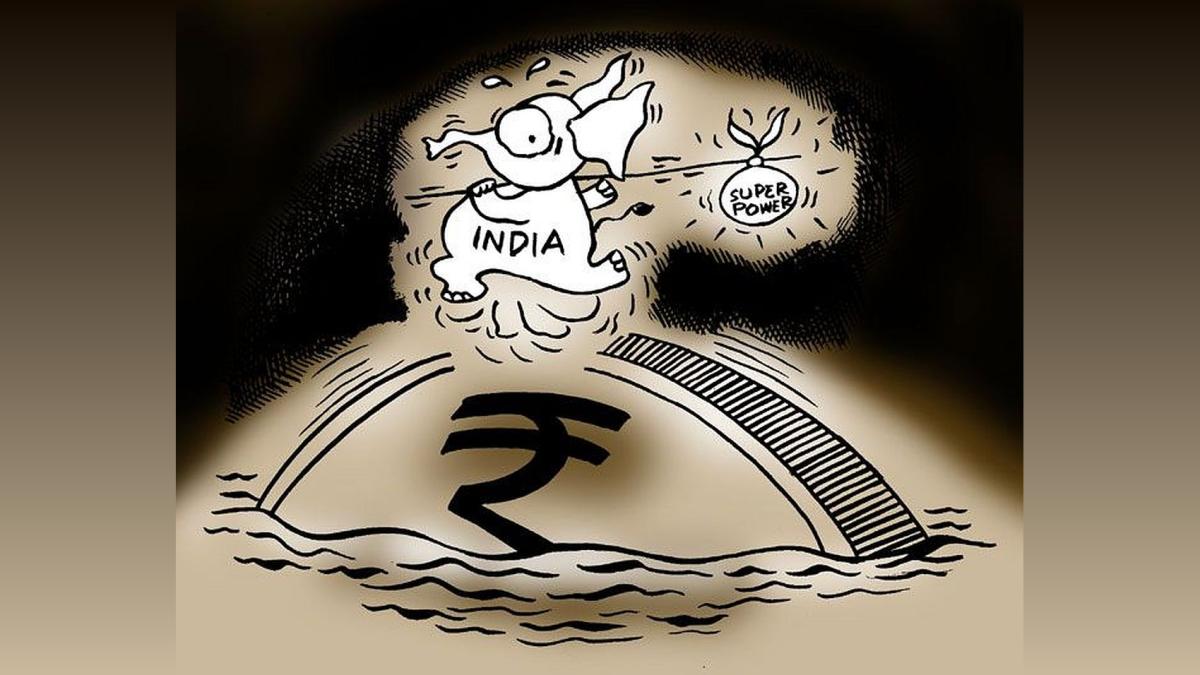

Illustration: Uttam Ghosh/Rediff.com

New Delhi, Jul 23 (PTI) Moody's Ratings on Tuesday projected general government debt to stabilise above 80 per cent of GDP over the next three years, down from 89.3 per cent in 2020-21.

"General government interest payments to fall to around 24 per cent of general government revenue over the next two years from over 28 per cent in fiscal 2020-21, although this remains much higher than the median 8.7 per cent recorded by Baa-rated peers," Moody's Ratings Associate Managing Director Gene Fang said in a post-budget reaction.

The Union Budget for fiscal 2024-25 maintains the fiscal consolidation path announced in the interim budget with the fiscal deficit target of 4.9 per cent this year and 4.5 per cent next year.

Higher gross GST and direct tax collections are expected to drive revenue growth in the ongoing fiscal, while a stronger-than-expected dividend payout from the Reserve Bank of India (RBI) has provided additional fiscal space, although future dividends will depend on market conditions, Fang said.

He further said that policy continuity is reflected in the government's capital spending on infrastructure, which remains around 23 per cent of total expenditure, although this remains below the 24 per cent spending on interest payments.

"Overall, the budget is credit positive as it is expected to keep fiscal deficits at around 4.9 per cent of GDP, lower than the 5.1 per cent of GDP announced in the interim budget. This places the government's goal of achieving a 4.5 per cent of GDP deficit by fiscal 2025-26 within reach," he added.

In absolute terms, the fiscal deficit has accordingly come down to Rs 16.14 lakh crore against Rs 16.85 lakh crore estimated earlier for the current financial year.

"General government interest payments to fall to around 24 per cent of general government revenue over the next two years from over 28 per cent in fiscal 2020-21, although this remains much higher than the median 8.7 per cent recorded by Baa-rated peers," Moody's Ratings Associate Managing Director Gene Fang said in a post-budget reaction.

The Union Budget for fiscal 2024-25 maintains the fiscal consolidation path announced in the interim budget with the fiscal deficit target of 4.9 per cent this year and 4.5 per cent next year.

Higher gross GST and direct tax collections are expected to drive revenue growth in the ongoing fiscal, while a stronger-than-expected dividend payout from the Reserve Bank of India (RBI) has provided additional fiscal space, although future dividends will depend on market conditions, Fang said.

He further said that policy continuity is reflected in the government's capital spending on infrastructure, which remains around 23 per cent of total expenditure, although this remains below the 24 per cent spending on interest payments.

"Overall, the budget is credit positive as it is expected to keep fiscal deficits at around 4.9 per cent of GDP, lower than the 5.1 per cent of GDP announced in the interim budget. This places the government's goal of achieving a 4.5 per cent of GDP deficit by fiscal 2025-26 within reach," he added.

In absolute terms, the fiscal deficit has accordingly come down to Rs 16.14 lakh crore against Rs 16.85 lakh crore estimated earlier for the current financial year.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005