India's Ship Recycling Industry to Grow to 4.2 Million GT by 2025

By Rediff Money Desk, Mumbai Oct 10, 2024 21:24

India's ship recycling industry is projected to reach 3.8-4.2 million GT in 2025, driven by a surge in obsolete ships and stable scrap prices. Learn more about the industry's growth and key factors influencing its expansion.

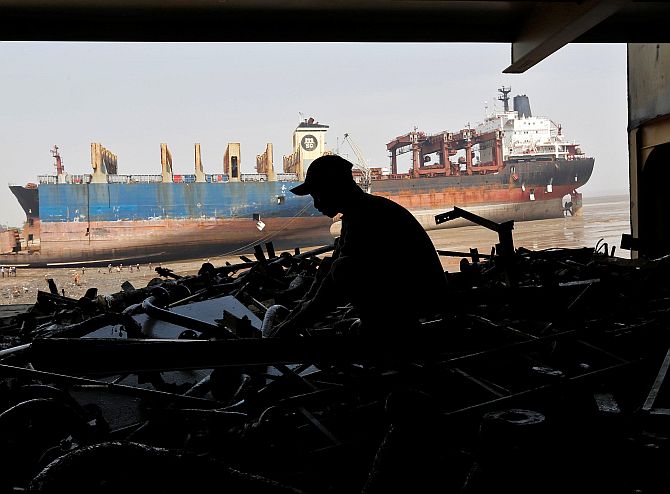

Photograph: Amit Dave/Reuters

Mumbai, Oct 10 (PTI) India's ship recycling industry is expected to grow to 3.8-4.2-million GT (gross tonnage) in 2025, as against an estimated 2.3-2.6-million GT in 2024, according to a report.

According to CareEdge, India accounts for 33 per cent of the global gross tonnage dismantled in 2023, second only to Bangladesh, which handled 46 per cent.

"India's ship recycling Industry is poised for major growth in CY25 and is expected to witness similar recycling level in CY24 with an estimate of 2.3 to 2.6 million GT, thereafter a jump to over 3.8 to 4.2 million GT in CY25," said Sajani Shah, Assistant Director at CareEdge.

The ship recycling industry in India is expected to grow at compound annual growth rate of around 10 per cent in CY26-CY28, she said, adding cooling-off of Baltic Dry Index, stabilisation of heavy melting scrap prices, and increase in obsolete ships in operations, suggest that more ships will enter the recycling market from CY25 onwards.

According to Shah, countries having better infrastructure and green recycling facilities are expected to attract a larger portion of ships in future.

India's share in the global recycling industry remained around 27 per cent in the past, before increasing to around 33 per cent in CY22 and CY23, reflecting a rise in its contribution amidst global declines.

In terms of volume, in CY22 and CY23, India dismantled 2.26 and 2.47 million GT, respectively, CareEdge said.

Ship recyclers are supported by favourable financial structure owing to low debt levels in lower ship recycling activities, low fixed overheads and contract-based employees in the operations. Further, Convergence of factors such as stability in freight and steel scrap prices with expected increase in availability of obsolete ships implies ship recycling activity will rise going forward, it said.

It also said that decline in global ship-recycling activities combined with stable addition in shipping capacity in recent years highlights the growing number of obsolete vessels still in operation.

As newer, more efficient vessels are introduced, older ships become increasingly unviable for operation. This trend creates a rising need for ship recycling, as operators seek to retire aging vessels that are no longer economically feasible to maintain, the ratings agency stated.

According to the report, the Indian ship recycling sector activity faced a decline amid rise in heavy melting scrap prices in FY23 and FY24.

Prices for heavy melting scrap at Bhavnagar, in Gujarat surged from Rs 28,800 per tonne in August 2020 to a peak of Rs 54,400 per tonne in April 2022, driven by supply chain disruptions and heightened demand for steel amid post-pandemic economic recovery efforts.

However, after peaking, scrap prices began to decline, settling at Rs 39,900 per tonne in December 2023. Since January 2023, prices have stabilised between Rs 36,000 per tonne and Rs 44,000 per tonne, it said.

This recent stabilisation suggests that the market has adjusted to post-pandemic conditions, providing a more predictable cost structure for industries reliant on scrap metal, CareEdge stated.

India's ship-recycling industry is a crucial part of the global maritime sector with the top four countries -- Bangladesh, India, Pakistan, and Turkey -- ?dominating the ship-recycling industry, dismantling over 90 per cent of the global ship recycling volume, according to ICRA.

In India, Alang in Gujarat is among the largest ship recycling facilities in the world with over 140 recycling yards.

According to CareEdge, India accounts for 33 per cent of the global gross tonnage dismantled in 2023, second only to Bangladesh, which handled 46 per cent.

"India's ship recycling Industry is poised for major growth in CY25 and is expected to witness similar recycling level in CY24 with an estimate of 2.3 to 2.6 million GT, thereafter a jump to over 3.8 to 4.2 million GT in CY25," said Sajani Shah, Assistant Director at CareEdge.

The ship recycling industry in India is expected to grow at compound annual growth rate of around 10 per cent in CY26-CY28, she said, adding cooling-off of Baltic Dry Index, stabilisation of heavy melting scrap prices, and increase in obsolete ships in operations, suggest that more ships will enter the recycling market from CY25 onwards.

According to Shah, countries having better infrastructure and green recycling facilities are expected to attract a larger portion of ships in future.

India's share in the global recycling industry remained around 27 per cent in the past, before increasing to around 33 per cent in CY22 and CY23, reflecting a rise in its contribution amidst global declines.

In terms of volume, in CY22 and CY23, India dismantled 2.26 and 2.47 million GT, respectively, CareEdge said.

Ship recyclers are supported by favourable financial structure owing to low debt levels in lower ship recycling activities, low fixed overheads and contract-based employees in the operations. Further, Convergence of factors such as stability in freight and steel scrap prices with expected increase in availability of obsolete ships implies ship recycling activity will rise going forward, it said.

It also said that decline in global ship-recycling activities combined with stable addition in shipping capacity in recent years highlights the growing number of obsolete vessels still in operation.

As newer, more efficient vessels are introduced, older ships become increasingly unviable for operation. This trend creates a rising need for ship recycling, as operators seek to retire aging vessels that are no longer economically feasible to maintain, the ratings agency stated.

According to the report, the Indian ship recycling sector activity faced a decline amid rise in heavy melting scrap prices in FY23 and FY24.

Prices for heavy melting scrap at Bhavnagar, in Gujarat surged from Rs 28,800 per tonne in August 2020 to a peak of Rs 54,400 per tonne in April 2022, driven by supply chain disruptions and heightened demand for steel amid post-pandemic economic recovery efforts.

However, after peaking, scrap prices began to decline, settling at Rs 39,900 per tonne in December 2023. Since January 2023, prices have stabilised between Rs 36,000 per tonne and Rs 44,000 per tonne, it said.

This recent stabilisation suggests that the market has adjusted to post-pandemic conditions, providing a more predictable cost structure for industries reliant on scrap metal, CareEdge stated.

India's ship-recycling industry is a crucial part of the global maritime sector with the top four countries -- Bangladesh, India, Pakistan, and Turkey -- ?dominating the ship-recycling industry, dismantling over 90 per cent of the global ship recycling volume, according to ICRA.

In India, Alang in Gujarat is among the largest ship recycling facilities in the world with over 140 recycling yards.

Source: PTI

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Srestha Finvest

- 0.89 (+ 4.71)

- 84074150

- Jaiprakash Power Ven

- 22.89 (+ 3.34)

- 47620916

- Spicejet Ltd.

- 65.25 ( -0.78)

- 27318841

- AvanceTechnologies

- 0.90 (+ 4.65)

- 26883863

- Vodafone Idea L

- 9.32 (+ 1.41)

- 26185410

MORE NEWS

Indian Student Becomes 'British High...

Delhi University student Nidhi Gautam experienced a day as the British High...

Samsung Workers Detained, Released: CITU...

Samsung India Electronics workers and CITU leaders were arrested and released after...

Garuda Construction IPO Oversubscribed 7.55 Times

Garuda Construction and Engineering IPO received 7.55 times subscription on the final...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.