India's Trade Deficit with Top 10 Partners in 2023-24

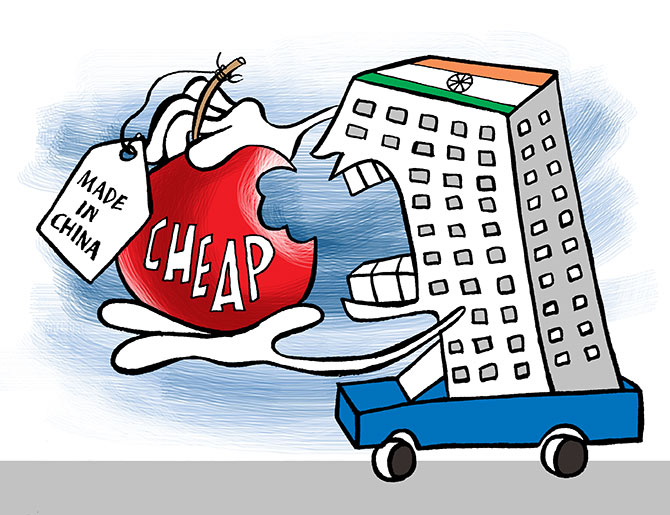

India recorded a trade deficit with nine of its top 10 trading partners in 2023-24, including China, Russia, Singapore, and Korea. Learn about the details and implications.

New Delhi, May 26 (PTI) India has recorded a trade deficit, the difference between imports and exports, with nine of its top 10 trading partners, including China, Russia, Singapore, and Korea, in 2023-24, according to official data.

The data also showed that the deficit with China, Russia, Korea, and Hong Kong increased in the last fiscal compared to 2022-23, while the trade gap with the UAE, Saudi Arabia, Russia, Indonesia, and Iraq narrowed.

The trade deficit with China rose to USD 85 billion, Russia to USD 57.2 billion, Korea to USD 14.71 billion and Hong Kong to USD 12.2 billion in 2023-24 against USD 83.2 billion, USD 43 billion, USD 14.57 billion and USD 8.38 billion, respectively, in 2022-23.

China has emerged as India's largest trading partner with USD 118.4 billion of two-way commerce in 2023-24, edging past the US.

The bilateral trade between India and the US stood at USD 118.28 billion in 2023-24. Washington was the top trading partner of New Delhi during 2021-22 and 2022-23.

India has a free trade agreement with four of its top trading partners - Singapore, the UAE, Korea and Indonesia (as part of the Asian bloc).

India has a trade surplus of USD 36.74 billion with the US in 2023-24. America is one of the few countries with which India has a trade surplus. The surplus is also there with the UK, Belgium, Italy, France and Bangladesh.

India's total trade deficit in the last fiscal narrowed to USD 238.3 billion as against USD 264.9 billion in the previous fiscal.

According to trade experts, a deficit is not always bad, if a country is importing raw materials or intermediary products to boost manufacturing and exports. However, it puts pressure on the domestic currency.

Economic think tank Global Trade Research Initiative (GTRI) said that a bilateral trade deficit with a country isn't a major issue unless it makes us overly reliant on that country's critical supplies. However, a rising overall trade deficit is harmful to the economy.

"A rising trade deficit, even from importing raw materials and intermediates, can cause the country's currency to depreciate because more foreign currency is needed for imports. This depreciation makes imports more expensive, worsening the deficit," GTRI Founder Ajay Srivastava said.

He said that to cover the growing deficit, the country might need to borrow more from foreign lenders, increasing external debt and this can deplete foreign exchange reserves and signal economic instability to investors, leading to reduced foreign investment.

"Cutting trade deficit requires boosting exports, reducing unnecessary imports, developing domestic industries, and managing currency and debt levels effectively," Srivastava added.

The data also showed that the deficit with China, Russia, Korea, and Hong Kong increased in the last fiscal compared to 2022-23, while the trade gap with the UAE, Saudi Arabia, Russia, Indonesia, and Iraq narrowed.

The trade deficit with China rose to USD 85 billion, Russia to USD 57.2 billion, Korea to USD 14.71 billion and Hong Kong to USD 12.2 billion in 2023-24 against USD 83.2 billion, USD 43 billion, USD 14.57 billion and USD 8.38 billion, respectively, in 2022-23.

China has emerged as India's largest trading partner with USD 118.4 billion of two-way commerce in 2023-24, edging past the US.

The bilateral trade between India and the US stood at USD 118.28 billion in 2023-24. Washington was the top trading partner of New Delhi during 2021-22 and 2022-23.

India has a free trade agreement with four of its top trading partners - Singapore, the UAE, Korea and Indonesia (as part of the Asian bloc).

India has a trade surplus of USD 36.74 billion with the US in 2023-24. America is one of the few countries with which India has a trade surplus. The surplus is also there with the UK, Belgium, Italy, France and Bangladesh.

India's total trade deficit in the last fiscal narrowed to USD 238.3 billion as against USD 264.9 billion in the previous fiscal.

According to trade experts, a deficit is not always bad, if a country is importing raw materials or intermediary products to boost manufacturing and exports. However, it puts pressure on the domestic currency.

Economic think tank Global Trade Research Initiative (GTRI) said that a bilateral trade deficit with a country isn't a major issue unless it makes us overly reliant on that country's critical supplies. However, a rising overall trade deficit is harmful to the economy.

"A rising trade deficit, even from importing raw materials and intermediates, can cause the country's currency to depreciate because more foreign currency is needed for imports. This depreciation makes imports more expensive, worsening the deficit," GTRI Founder Ajay Srivastava said.

He said that to cover the growing deficit, the country might need to borrow more from foreign lenders, increasing external debt and this can deplete foreign exchange reserves and signal economic instability to investors, leading to reduced foreign investment.

"Cutting trade deficit requires boosting exports, reducing unnecessary imports, developing domestic industries, and managing currency and debt levels effectively," Srivastava added.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005