India's Economy on Sustainable Growth Path: RBI Guv Das

RBI Governor Shaktikanta Das highlights India's robust economic fundamentals and sustainable growth path, urging private sector investment. Key drivers include a young population, diverse economy, and robust democracy.

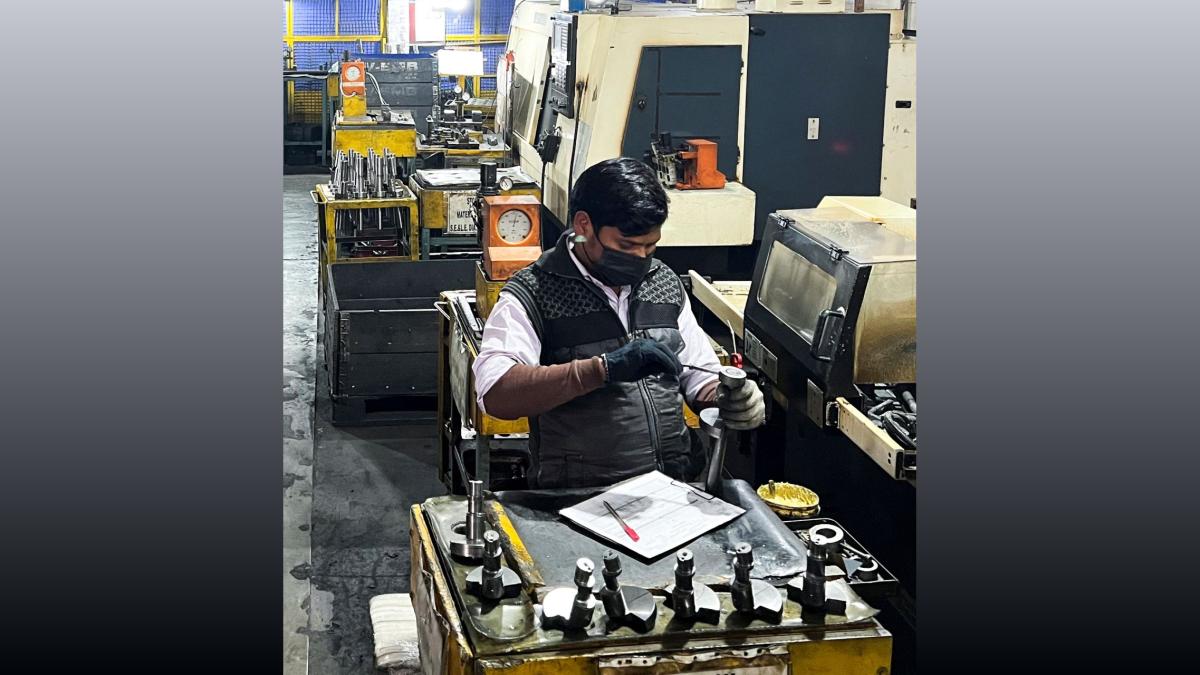

Photograph: Reuters

Mumbai, Sep 5 (PTI) Reserve Bank Governor Shaktikanta Das on Thursday said the fundamental drivers of the Indian economy are gaining momentum and the country is moving on a sustainable growth path.

In the inaugural address at FIBAC 2024, the governor said that massive changes are taking shape in various economic sectors and markets, and the country is geared for orbital shifts.

"Our nation's journey towards becoming an advanced economy is drawing strength from a unique blend of factors, and these factors would include a young and a dynamic population, a resilient and diverse economy, robust democracy, and a rich tradition of entrepreneurship and innovation," Das said.

Stressing that India's growth story is intact and banks have robust balance sheets, he exhorted the private sector to step up investments in a big way.

He said data actually shows that the fundamental growth drivers of the Indian economy are actually gaining momentum and they are not slowing. "This gives us the confidence to say that the Indian growth story remains intact," he said.

In his speech, the governor said past reforms like GST and IBC have yielded long-term positive outcomes, and emphasised the need for further reforms in land, labour, and agri markets.

While acknowledging that headline inflation matters, he said the balance between inflation and growth is well-poised.

With monsoon progressing well and healthy Kharif sowing, food inflation outlook could become more favourable, he added.

Das further said the financial sector must expand access and harness digital platforms to drive inclusive growth.

He also made a strong case for tailored products and services for women-led businesses and MSMEs without diluting underwriting standards.

Das further noted that only regulated entities will be allowed on Unified Lending Interface (ULI) platform to ensure prudent lending. "ULI will not be a select club of few players," Das said.

In the inaugural address at FIBAC 2024, the governor said that massive changes are taking shape in various economic sectors and markets, and the country is geared for orbital shifts.

"Our nation's journey towards becoming an advanced economy is drawing strength from a unique blend of factors, and these factors would include a young and a dynamic population, a resilient and diverse economy, robust democracy, and a rich tradition of entrepreneurship and innovation," Das said.

Stressing that India's growth story is intact and banks have robust balance sheets, he exhorted the private sector to step up investments in a big way.

He said data actually shows that the fundamental growth drivers of the Indian economy are actually gaining momentum and they are not slowing. "This gives us the confidence to say that the Indian growth story remains intact," he said.

In his speech, the governor said past reforms like GST and IBC have yielded long-term positive outcomes, and emphasised the need for further reforms in land, labour, and agri markets.

While acknowledging that headline inflation matters, he said the balance between inflation and growth is well-poised.

With monsoon progressing well and healthy Kharif sowing, food inflation outlook could become more favourable, he added.

Das further said the financial sector must expand access and harness digital platforms to drive inclusive growth.

He also made a strong case for tailored products and services for women-led businesses and MSMEs without diluting underwriting standards.

Das further noted that only regulated entities will be allowed on Unified Lending Interface (ULI) platform to ensure prudent lending. "ULI will not be a select club of few players," Das said.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Welcure-Drugs-and

- 0.46 ( -4.17)

- 14811536

- Vodafone-Idea

- 11.26 ( -0.88)

- 14748672

- Sylph-Technologies

- 1.00 (+ 3.09)

- 9743197

- Meesho-L

- 190.40 (+ 11.51)

- 6132017

- Sunshine-Capital

- 0.27 (+ 3.85)

- 4790793