Inflation Surges, Factory Output Slows: India's Economy Faces Challenges

India's retail inflation rose to 5.69% in December, while industrial production dipped to a low in November, indicating economic headwinds.

New Delhi, Jan 12 (PTI) In a double whammy for the economy, retail inflation soared to a four-month high of 5.69 per cent in December, while industrial production fell to an 8-month low of 2.4 per cent in November, according to a set of government data released on Friday.

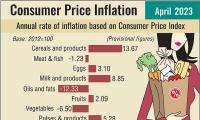

The annual retail inflation based on the Consumer Price Index (CPI) rose, mainly due to a spurt in prices of vegetables, pulses and spices, as per the data.

The inflation was 5.55 per cent in November 2023 and 5.72 per cent in the year-ago month (December 2022).

As per the data released by the National Statistical Office (NSO), the rate of price rise in the food basket, which constitutes nearly half of the CPI, increased to 9.53 per cent in December against 8.7 per cent in the preceding month and 4.19 per cent in December 2022.

The previous high inflation was recorded at 6.83 per cent in August this fiscal.

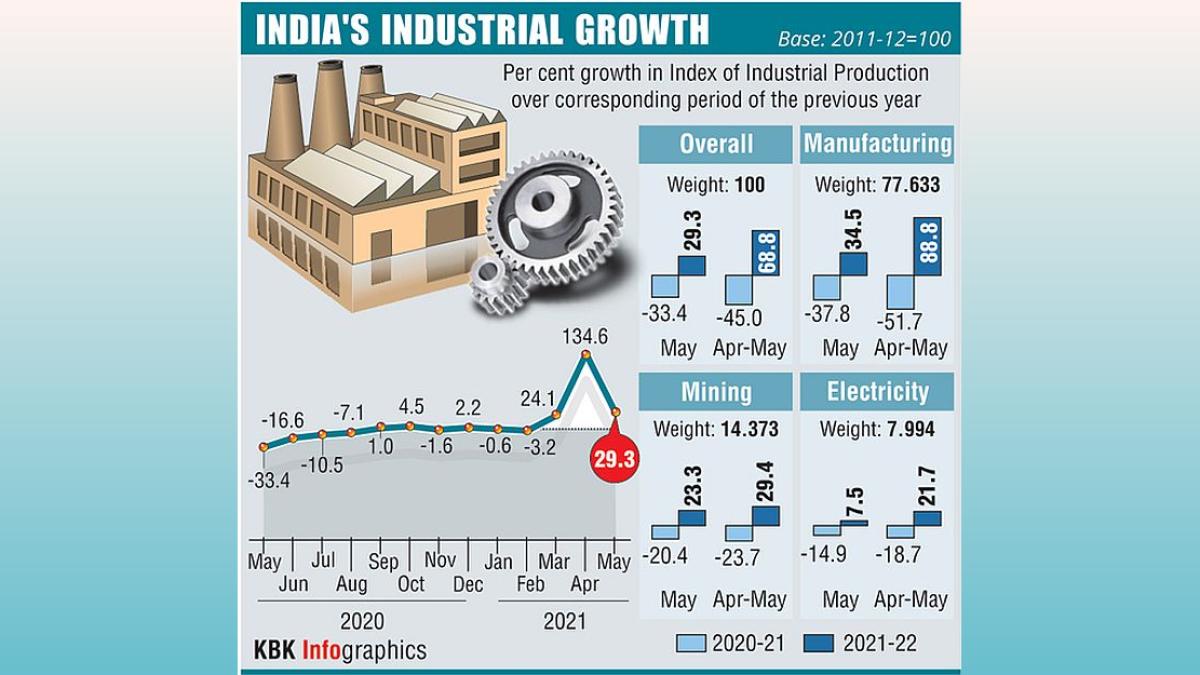

As regards the industrial output measured in terms of the Index of Industrial Production (IIP), the growth decelerated to 2.4 per cent in November, the lowest level in the current fiscal.

The IIP for October 2023 was revised to 11.6 per cent from provisional estimates of 11.7 released last month. It was 7.6 per cent in November 2022.

The previous low of IIP was at 1.9 per cent in March 2023.

The deceleration in the growth of IIP during November was mainly on account of poor show by the manufacturing sector, which reported a growth of 1.2 per cent during the month compared to 6.7 per cent a year ago.

The power generation growth also slowed to 5.8 per cent in November 2023 compared to 12.7 per cent growth in the year-ago period.

Mining output growth came down to 6.8 per cent in the month under review from 9.7 per cent growth a year ago.

As per use-based classification, the capital goods segment contracted 1.1 per cent in November this year compared to a growth of 20.7 per cent in the year-ago month.

Consumer durables output during the month declined by 5.4 per cent against 5 per cent growth a year ago.

Consumer non-durable goods output contracted by 3.6 per cent compared to a 10 per cent expansion a year earlier.

Infrastructure/construction goods reported a marginal growth of 1.5 per cent against a 14.3 per cent expansion.

The data also showed that the output of primary goods logged 8.4 per cent growth in the month compared to 4.8 per cent in the year-ago period.

The intermediate goods output in November remained flat at 3.5 per cent.

The latest CPI data showed that inflation in the vegetable segment was 27.64 per cent on an annual basis, followed by 'pulses and products' at 20.73 per cent and spices at 19.69 per cent.

However, prices of 'oil and fats' declined by 14.96 per cent.

The retail inflation was higher in rural areas at 5.93 per cent in December, while it was 5.46 per cent in urban India.

However, the inflation in the food basket was lower in rural areas compared to urban centres.

Aditi Nayar, Chief Economist, Icra, said the sequential uptick in the headline CPI inflation in December 2023 was entirely led by the food and beverages segment, with all the other sub-groups either reporting an easing or similar year-on-year prints compared to the previous month.

"Within the food segment, vegetables were expectedly the main culprit, even as seven of the 12 sub-segments witnessed a moderation in their year-on-year inflation print in the month," she said.

The Reserve Bank of India has been tasked by the government to ensure retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

According to the NSO data, the lowest inflation was witnessed in Delhi at 2.95 per cent and the highest in Odisha at 8.73 per cent.

The annual retail inflation based on the Consumer Price Index (CPI) rose, mainly due to a spurt in prices of vegetables, pulses and spices, as per the data.

The inflation was 5.55 per cent in November 2023 and 5.72 per cent in the year-ago month (December 2022).

As per the data released by the National Statistical Office (NSO), the rate of price rise in the food basket, which constitutes nearly half of the CPI, increased to 9.53 per cent in December against 8.7 per cent in the preceding month and 4.19 per cent in December 2022.

The previous high inflation was recorded at 6.83 per cent in August this fiscal.

As regards the industrial output measured in terms of the Index of Industrial Production (IIP), the growth decelerated to 2.4 per cent in November, the lowest level in the current fiscal.

The IIP for October 2023 was revised to 11.6 per cent from provisional estimates of 11.7 released last month. It was 7.6 per cent in November 2022.

The previous low of IIP was at 1.9 per cent in March 2023.

The deceleration in the growth of IIP during November was mainly on account of poor show by the manufacturing sector, which reported a growth of 1.2 per cent during the month compared to 6.7 per cent a year ago.

The power generation growth also slowed to 5.8 per cent in November 2023 compared to 12.7 per cent growth in the year-ago period.

Mining output growth came down to 6.8 per cent in the month under review from 9.7 per cent growth a year ago.

As per use-based classification, the capital goods segment contracted 1.1 per cent in November this year compared to a growth of 20.7 per cent in the year-ago month.

Consumer durables output during the month declined by 5.4 per cent against 5 per cent growth a year ago.

Consumer non-durable goods output contracted by 3.6 per cent compared to a 10 per cent expansion a year earlier.

Infrastructure/construction goods reported a marginal growth of 1.5 per cent against a 14.3 per cent expansion.

The data also showed that the output of primary goods logged 8.4 per cent growth in the month compared to 4.8 per cent in the year-ago period.

The intermediate goods output in November remained flat at 3.5 per cent.

The latest CPI data showed that inflation in the vegetable segment was 27.64 per cent on an annual basis, followed by 'pulses and products' at 20.73 per cent and spices at 19.69 per cent.

However, prices of 'oil and fats' declined by 14.96 per cent.

The retail inflation was higher in rural areas at 5.93 per cent in December, while it was 5.46 per cent in urban India.

However, the inflation in the food basket was lower in rural areas compared to urban centres.

Aditi Nayar, Chief Economist, Icra, said the sequential uptick in the headline CPI inflation in December 2023 was entirely led by the food and beverages segment, with all the other sub-groups either reporting an easing or similar year-on-year prints compared to the previous month.

"Within the food segment, vegetables were expectedly the main culprit, even as seven of the 12 sub-segments witnessed a moderation in their year-on-year inflation print in the month," she said.

The Reserve Bank of India has been tasked by the government to ensure retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

According to the NSO data, the lowest inflation was witnessed in Delhi at 2.95 per cent and the highest in Odisha at 8.73 per cent.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005