RBI Curbs Loan Evergreening Through AIFs

Reserve Bank of India (RBI) restricts banks and NBFCs from investing in AIFs with investments in their loan borrowers, aiming to curb evergreening practices.

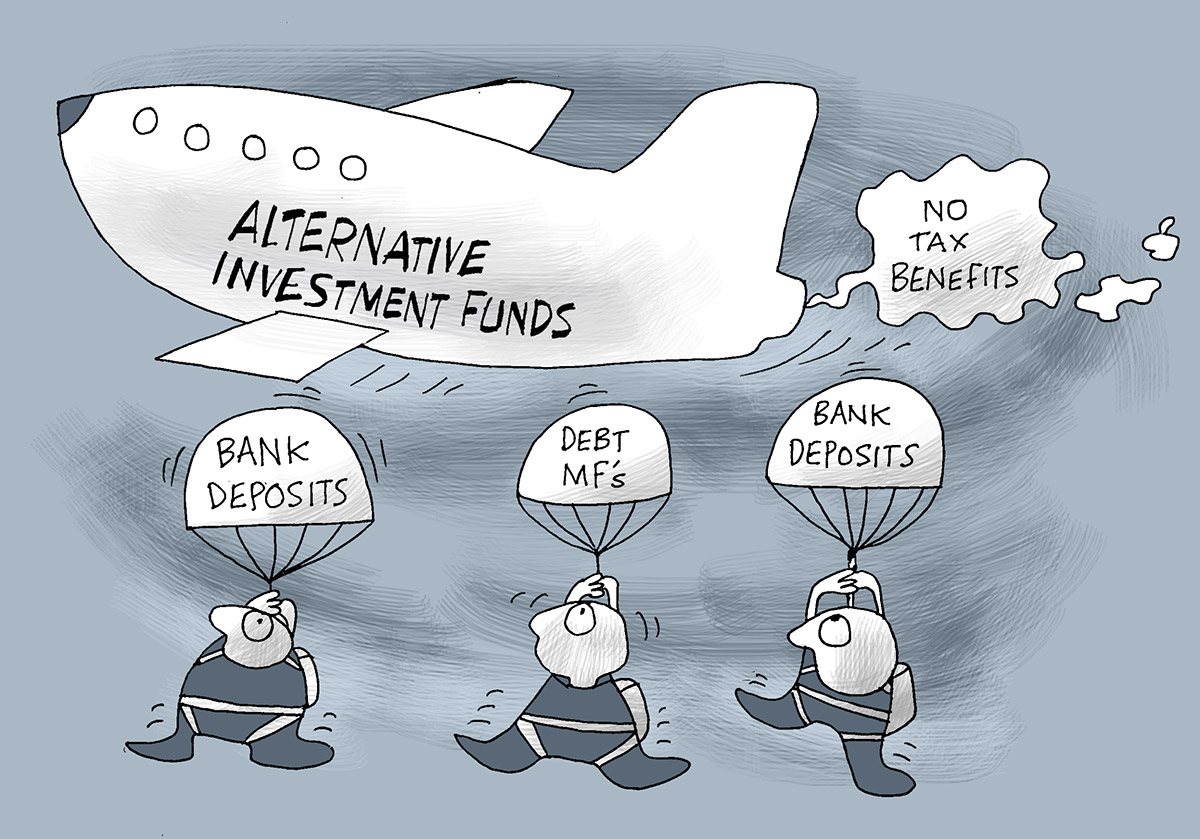

Illustration: Uttam Ghosh/Rediff.com

Mumbai, Dec 19 (PTI) In a move to curb "evergreening" of loans, the Reserve Bank on Tuesday barred banks and NBFCs from investing in any scheme of Alternative Investment Funds (AIFs) having investment in companies that have taken loan from the lenders concerned in the past 12 months.

Banks and NBFCs, which are Regulated Entities (RE) under the Reserve Bank of India (RBI), make investments in units of AIFs as part of their regular investment operations.

Venture capital funds, angle funds, infrastructure funds, private equity funds and hedge funds, among others, are AIFs.

In a circular, RBI said, "certain transactions of REs involving AIFs that raise regulatory concerns have come to our notice".

These transactions entail substitution of direct loan exposure of REs to borrowers, with indirect exposure through investments in units of AIFs, it said.

RBI said that in order to address concerns relating to possible evergreening through this route", REs cannot make investments in any scheme of AIFs which has downstream investments either directly or indirectly in a debtor company of the lender.

Further, it has directed lenders that such investments would be required to be liquidated within 30 days.

In case, REs are not able to liquidate their investments within the prescribed time limit, they should make 100 per cent provision on such investments, it added.

The debtor company of the RE means any entity to which the lender currently has or previously had a loan or investment exposure anytime during the preceding 12 months.

Banks and NBFCs, which are Regulated Entities (RE) under the Reserve Bank of India (RBI), make investments in units of AIFs as part of their regular investment operations.

Venture capital funds, angle funds, infrastructure funds, private equity funds and hedge funds, among others, are AIFs.

In a circular, RBI said, "certain transactions of REs involving AIFs that raise regulatory concerns have come to our notice".

These transactions entail substitution of direct loan exposure of REs to borrowers, with indirect exposure through investments in units of AIFs, it said.

RBI said that in order to address concerns relating to possible evergreening through this route", REs cannot make investments in any scheme of AIFs which has downstream investments either directly or indirectly in a debtor company of the lender.

Further, it has directed lenders that such investments would be required to be liquidated within 30 days.

In case, REs are not able to liquidate their investments within the prescribed time limit, they should make 100 per cent provision on such investments, it added.

The debtor company of the RE means any entity to which the lender currently has or previously had a loan or investment exposure anytime during the preceding 12 months.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.72 (+ 0.60)

- 35946923

- Spright-Agro

- 0.77 ( -4.94)

- 15184368

- Harshil-Agrotech

- 0.60 ( -1.64)

- 12119486

- Mehai-Technology

- 1.65 ( -4.62)

- 9795340

- AvanceTechnologies

- 1.06 ( -4.50)

- 7136782