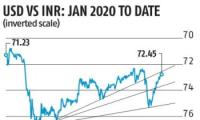

Rupee Rises 6 Paise to Close at 83.90 Against US Dollar

The Indian rupee closed 6 paise higher at 83.90 against the US dollar on Friday, supported by a weaker dollar and foreign fund inflows. Read more about the rupee's performance and other market updates.

Mumbai, Sep 13 (PTI) The rupee witnessed range-bound trade and settled for the day higher by 6 paise at 83.90 (provisional) against the US dollar on Friday supported by weakening of the American currency in the overseas market and significant foreign fund inflows.

Forex traders said rupee trade was range-bound as the Reserve Bank of India (RBI) is maintaining a firm grip on the domestic currency.

At the interbank foreign exchange market, the local unit opened at 83.92 and witnessed an intraday high of 83.85 and a low of 83.98 against the American currency.

The domestic unit finally settled for the day at 83.90 (provisional), higher by 6 paise over its previous close.

On Thursday, the local unit settled 3 paise higher at 83.96 against the US dollar.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was down 0.46 per cent to 100.90 points.

Brent crude, the international benchmark, gained 1.03 per cent to USD 72.71 per barrel in futures trade.

In the domestic equity market, the 30-share BSE Sensex declined 71.77 points, or 0.09 per cent, to close at 82,890.94 points, while the Nifty fell 32.40 points, or 0.13 per cent, to 25,356.50 points.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Thursday, as they purchased shares worth Rs 7,695.00 crore, according to exchange data.

On the domestic macroeconomic front, retail inflation in August inched up to 3.65 per cent, though vegetables and pulses witnessed price rise in double digits, according to official data released on Thursday.

India's industrial production output decelerated to 4.8 per cent year-on-year in July 2024, mainly due to poor performance of the manufacturing and mining sectors, as per official data released on Thursday.

Forex traders said rupee trade was range-bound as the Reserve Bank of India (RBI) is maintaining a firm grip on the domestic currency.

At the interbank foreign exchange market, the local unit opened at 83.92 and witnessed an intraday high of 83.85 and a low of 83.98 against the American currency.

The domestic unit finally settled for the day at 83.90 (provisional), higher by 6 paise over its previous close.

On Thursday, the local unit settled 3 paise higher at 83.96 against the US dollar.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was down 0.46 per cent to 100.90 points.

Brent crude, the international benchmark, gained 1.03 per cent to USD 72.71 per barrel in futures trade.

In the domestic equity market, the 30-share BSE Sensex declined 71.77 points, or 0.09 per cent, to close at 82,890.94 points, while the Nifty fell 32.40 points, or 0.13 per cent, to 25,356.50 points.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Thursday, as they purchased shares worth Rs 7,695.00 crore, according to exchange data.

On the domestic macroeconomic front, retail inflation in August inched up to 3.65 per cent, though vegetables and pulses witnessed price rise in double digits, according to official data released on Thursday.

India's industrial production output decelerated to 4.8 per cent year-on-year in July 2024, mainly due to poor performance of the manufacturing and mining sectors, as per official data released on Thursday.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005