Savings Concerns: Indians Fear Not Enough for Future

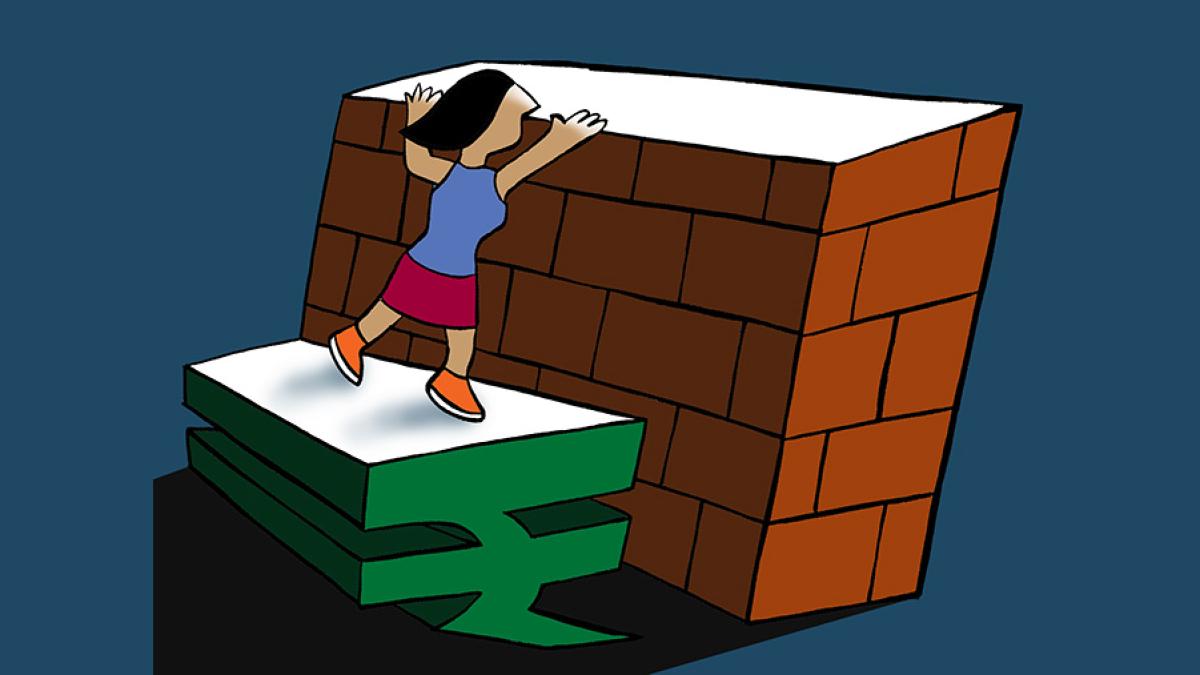

A new study reveals that over half of Indians aged 35-54 worry their savings are insufficient for the future, despite having financial plans. The study highlights concerns about credit reliance and meeting both essential and aspirational needs.

Mumbai, Feb 22 (PTI) More than half of Indians surveyed feel unprepared for their future despite having a detailed financial plan or having done some degree of planning, says a study.

The study of individuals in the age group of 35 to 54 years who financially provide for their ageing parents and growing children found that 60 per cent of respondents feel their savings are not enough for future.

The respondents agree that "no matter how much they save or invest, they feel like it's never enough for future", the study by YouGov said.

A majority 94 per cent of respondents said they either have a detailed financial plan or have done some degree of planning, the study, which surveyed more than 4,000 people across 12 cities across India, said.

The study of aspirations, attitudes and financial preparedness of individuals in the 35-54 years age group stated stated that more than 50 per cent worry about running out of money, always feeling behind and not doing well enough despite efforts.

"They show high reliance on credit and also seem to be exhausting savings as well as income. 64 per cent fund their short-term aspirations via credit, 49 per cent savings, and 47 per cent regular future income," the study by YouGov and Edelweiss Life Insurance said.

They have also accessed all forms of credit to meet critical needs like healthcare, education, etc. and also wants like vacation, home renovation, etc, it added.

Their long-term aspirations are on shaky ground as 79 per cent expect to fund their long-term aspirations through returns or gains from financial instruments.

According to Sumit Rai, MD & CEO, Edelweiss Life Insurance said, "Through our customer interactions over the years, we have closely seen how Sandwich Generation is living in a cycle of caring for their parents and children".

They want to enable the essentials like healthcare and education while providing an aspirational life where 'needs' don't come at the cost of 'wants', Rai said.

The study of individuals in the age group of 35 to 54 years who financially provide for their ageing parents and growing children found that 60 per cent of respondents feel their savings are not enough for future.

The respondents agree that "no matter how much they save or invest, they feel like it's never enough for future", the study by YouGov said.

A majority 94 per cent of respondents said they either have a detailed financial plan or have done some degree of planning, the study, which surveyed more than 4,000 people across 12 cities across India, said.

The study of aspirations, attitudes and financial preparedness of individuals in the 35-54 years age group stated stated that more than 50 per cent worry about running out of money, always feeling behind and not doing well enough despite efforts.

"They show high reliance on credit and also seem to be exhausting savings as well as income. 64 per cent fund their short-term aspirations via credit, 49 per cent savings, and 47 per cent regular future income," the study by YouGov and Edelweiss Life Insurance said.

They have also accessed all forms of credit to meet critical needs like healthcare, education, etc. and also wants like vacation, home renovation, etc, it added.

Their long-term aspirations are on shaky ground as 79 per cent expect to fund their long-term aspirations through returns or gains from financial instruments.

According to Sumit Rai, MD & CEO, Edelweiss Life Insurance said, "Through our customer interactions over the years, we have closely seen how Sandwich Generation is living in a cycle of caring for their parents and children".

They want to enable the essentials like healthcare and education while providing an aspirational life where 'needs' don't come at the cost of 'wants', Rai said.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005