Sebi Allows Flexibility for Venture Capital Funds

Sebi provides flexibility to Venture Capital Funds (VCFs) to manage unliquidated investments beyond the scheme's tenure. The regulator also introduced a framework for NRIs, OCIs and RIs to invest in IFSC-based FPIs.

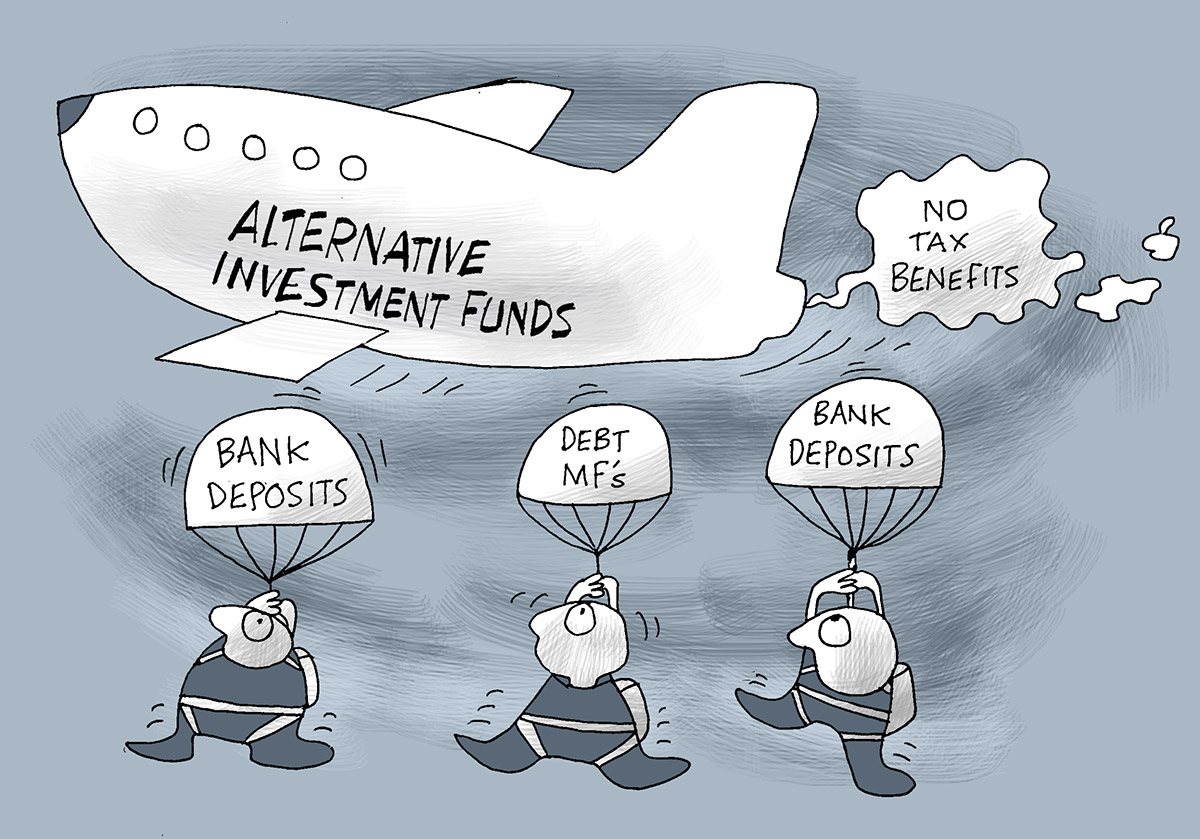

Illustration: Uttam Ghosh/Rediff.com

New Delhi, Apr 30 (PTI) Markets regulator Sebi on Tuesday decided to provide flexibility to Venture Capital Funds (VCFs) to deal with unliquidated investments of their schemes beyond the expiry of tenure.

Also, Sebi decided to put in place a framework that makes it easier for non-resident Indians, overseas citizens of India (OCI) and resident Indians (RIs) to participate in foreign portfolio investors (FPIs) based out of International Financial Services Centres (IFSCs) in India.

To address the issues faced by VCFs registered under the erstwhile VCF Regulations with respect to their inability to fully liquidate the investments of their schemes within the tenure of the scheme, the board has approved a proposal to provide an option to such VCFs to migrate into Alternative Investment Fund (AIF) norms and avail the facilities available for AIFs to deal with unliquidated investments.

This came after Sebi received representations from participants in the AIF industry highlighting certain tax-related issues. They also highlighted that setting up a liquidation scheme and winding up the original AIF scheme is a process involving time, cost, and efforts, which directly or indirectly, would ultimately be paid by investors.

Listing out the salient features of the framework for migration, Sebi, in a statement, said that a separate sub-category should be created under Category I AIFs-VCFs called "Migrated VCFs".

VCFs registered under the erstwhile VCF Regulations may opt to register themselves as Migrated VCFs. Further, no application fee or registration fee should be levied for the same. Moreover, migrated VCFs should not be subject to any additional investment conditions.

Further, migrated VCFs can avail the flexibilities under AIF Regulations with respect to an extension of tenure, liquidation period and dissolution period to deal with unliquidated investments.

"Schemes of VCFs whose tenure has expired and opt for migration shall be provided one year additional liquidation period, as long as they do not have any investor complaint with regard to non-receipt of funds or securities," Sebi said in a statement.

The option to migrate should be available for a period of 12 months from the date of notification of amendment to AIF Regulations in this regard.

Also, Sebi's board approved a regulatory framework to provide flexibility for increased contribution by NRIs, OCI and resident Indians RIs in the corpus of certain FPIs based out of IFSCs in India.

The funds set up in IFSC will be permitted to have 100 per cent contribution from NRIs, OCIs or RIs provided they submit PAN cards or self-declaration along with identity documents.

Funds who wish to have 100 per cent contribution from NRIs, OCIs or RIs can also do so without submitting these documents provided they meet certain conditions.

Apart from these, FPIs should be bound by disclosure obligations with respect to all entities holding any ownership, economic interest, or exercising control in the FPI on a look-through basis in certain conditions.

Also, Sebi decided to put in place a framework that makes it easier for non-resident Indians, overseas citizens of India (OCI) and resident Indians (RIs) to participate in foreign portfolio investors (FPIs) based out of International Financial Services Centres (IFSCs) in India.

To address the issues faced by VCFs registered under the erstwhile VCF Regulations with respect to their inability to fully liquidate the investments of their schemes within the tenure of the scheme, the board has approved a proposal to provide an option to such VCFs to migrate into Alternative Investment Fund (AIF) norms and avail the facilities available for AIFs to deal with unliquidated investments.

This came after Sebi received representations from participants in the AIF industry highlighting certain tax-related issues. They also highlighted that setting up a liquidation scheme and winding up the original AIF scheme is a process involving time, cost, and efforts, which directly or indirectly, would ultimately be paid by investors.

Listing out the salient features of the framework for migration, Sebi, in a statement, said that a separate sub-category should be created under Category I AIFs-VCFs called "Migrated VCFs".

VCFs registered under the erstwhile VCF Regulations may opt to register themselves as Migrated VCFs. Further, no application fee or registration fee should be levied for the same. Moreover, migrated VCFs should not be subject to any additional investment conditions.

Further, migrated VCFs can avail the flexibilities under AIF Regulations with respect to an extension of tenure, liquidation period and dissolution period to deal with unliquidated investments.

"Schemes of VCFs whose tenure has expired and opt for migration shall be provided one year additional liquidation period, as long as they do not have any investor complaint with regard to non-receipt of funds or securities," Sebi said in a statement.

The option to migrate should be available for a period of 12 months from the date of notification of amendment to AIF Regulations in this regard.

Also, Sebi's board approved a regulatory framework to provide flexibility for increased contribution by NRIs, OCI and resident Indians RIs in the corpus of certain FPIs based out of IFSCs in India.

The funds set up in IFSC will be permitted to have 100 per cent contribution from NRIs, OCIs or RIs provided they submit PAN cards or self-declaration along with identity documents.

Funds who wish to have 100 per cent contribution from NRIs, OCIs or RIs can also do so without submitting these documents provided they meet certain conditions.

Apart from these, FPIs should be bound by disclosure obligations with respect to all entities holding any ownership, economic interest, or exercising control in the FPI on a look-through basis in certain conditions.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea

- 11.36 ( -2.49)

- 94664837

- AvanceTechnologies

- 1.16 (+ 4.50)

- 34522155

- Sunshine-Capital

- 0.26 ( -3.70)

- 29015901

- Alstone-Textiles

- 0.27 ( -3.57)

- 28695959

- Mehai-Technology

- 1.65 ( -4.62)

- 28262795