Sebi Streamlines AIF Compliance: Direct PPM Changes Filing

Sebi allows AIFs to submit certain PPM changes directly to the regulator, reducing compliance costs and streamlining the process. Learn more about the new framework and its impact.

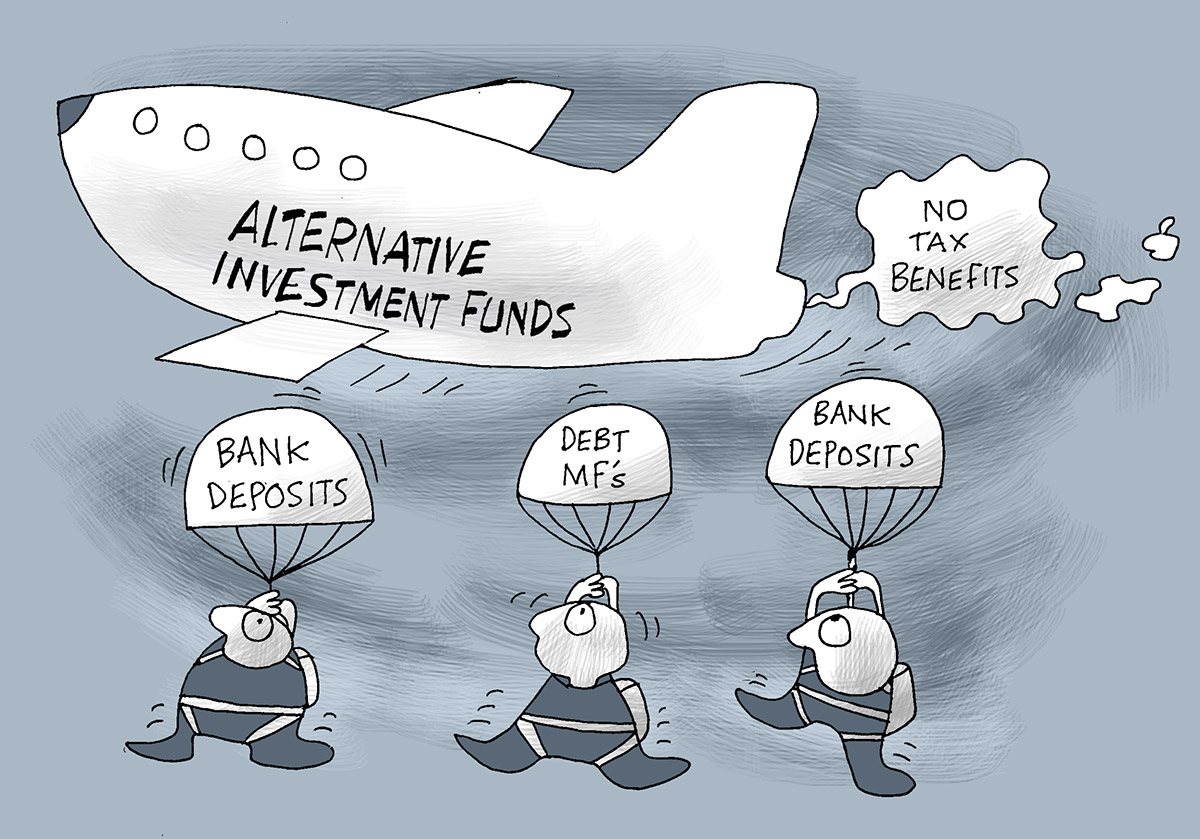

Illustration: Uttam Ghosh/Rediff.com

New Delhi, Apr 29 (PTI) To facilitate ease of doing business, Sebi on Monday said certain changes in the private placement memorandum of alternative investment funds can be submitted directly to the regulator rather than through a merchant banker.

The move would also rationalise the cost of compliance for alternative investment funds (AIFs).

The new framework would come into force with immediate effect, the Securities and Exchange Board of India (Sebi) said in a circular.

The regulator said that certain changes carried out in the Private Placement Memorandum (PPM) are not required to be filed through merchant bankers and can be filed directly to the regulator.

These included changes in the size of the fund, information related to affiliates, commitment period, key investment team of the manager and key management personnel of AIF, and reduction in expense or fee or cost charged to fund/investors.

Additionally, changes in contact details of AIF, sponsor, manager, trustee or custodian, auditor, RTA, legal advisor, risk factors and track records of investment manager, among others, are not required to be filed through a merchant banker.

On April 8, the regulator issued a draft circular and sought public comments on these proposals by April 26.

The move would also rationalise the cost of compliance for alternative investment funds (AIFs).

The new framework would come into force with immediate effect, the Securities and Exchange Board of India (Sebi) said in a circular.

The regulator said that certain changes carried out in the Private Placement Memorandum (PPM) are not required to be filed through merchant bankers and can be filed directly to the regulator.

These included changes in the size of the fund, information related to affiliates, commitment period, key investment team of the manager and key management personnel of AIF, and reduction in expense or fee or cost charged to fund/investors.

Additionally, changes in contact details of AIF, sponsor, manager, trustee or custodian, auditor, RTA, legal advisor, risk factors and track records of investment manager, among others, are not required to be filed through a merchant banker.

On April 8, the regulator issued a draft circular and sought public comments on these proposals by April 26.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 10.29 ( -4.72)

- 71162549

- Spicejet-Ltd

- 32.50 (+ 4.47)

- 59158929

- Alstone-Textiles

- 0.30 ( 0.00)

- 37245425

- Sunshine-Capital

- 0.25 ( 0.00)

- 25623281

- G-V-Films

- 0.63 ( -4.55)

- 21918363