Sensex Declines Over 1% on Reliance, Bajaj Finance Sell-Off

The BSE Sensex fell over 1% on Tuesday due to selling in Reliance Industries, ITC and Bajaj Finance, with investors cautious ahead of the Budget. Bajaj Finance declined after its December quarter earnings disappointed investors.

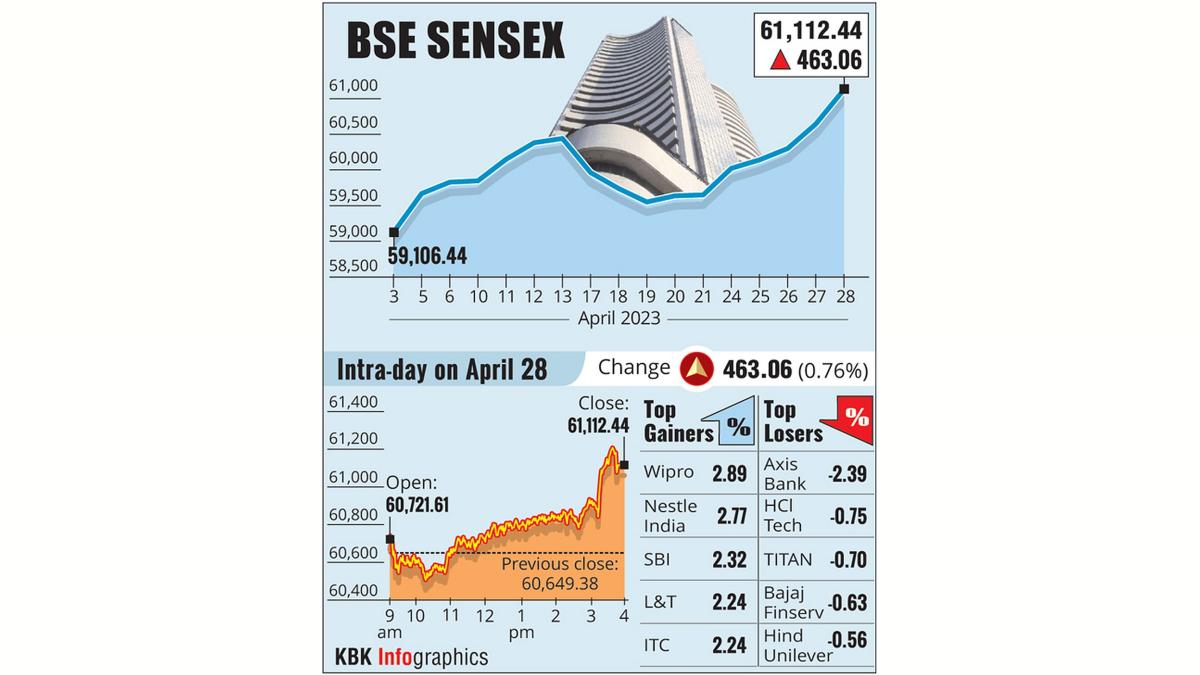

Photograph: PTI Photo

Mumbai, Jan 30 (PTI) Benchmark equity indices declined on Tuesday, a day after recording sharp gains, with the BSE Sensex falling over 1 per cent due to selling in Reliance Industries, ITC and Bajaj Finance.

The 30-share BSE Sensex fell by 801.67 points or 1.11 per cent to settle at 71,139.90. During the day, it plummeted 865.85 points or 1.20 per cent to 71,075.72.

The Nifty declined 215.50 points or 0.99 per cent to 21,522.10.

Among the Sensex firms, Bajaj Finance fell by 5.03 per cent after its December quarter earnings failed to cheer investors.

Titan, UltraTech Cement, Bajaj Finserv, Reliance Industries, ITC and NTPC were among the other major laggards.

Tata Motors, State Bank of India, Hindustan Unilever, Power Grid, Tech Mahindra and Tata Consultancy Services were the gainers.

"Selling intensified towards the fag end as investors further slashed their positions in key stocks ahead of the Budget while weakness in several Asian indices also contributed to the overall fall.

"With just one day left for the Budget, investors want to play it safe although there would not be any big-bang announcement by the government in this budget. Focus would rather shift to US Fed policy but indications are that it may maintain the status quo on interest rates, which could unsettle investors further," said Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd.

In the broader market, the BSE midcap gauge declined 0.53 per cent while smallcap index climbed 0.18 per cent.

Consumer durables declined 2.40 per cent, capital goods dipped 1.24 per cent, power (1.12 per cent), FMCG (1 per cent), utilities (0.92 per cent) and industrials (0.77 per cent).

Realty emerged as the only gainer.

In Asian markets, Tokyo settled in the positive territory while Seoul, Shanghai and Hong Kong ended lower.

European markets were trading with gains. The US markets ended higher on Monday.

Global oil benchmark Brent crude climbed 0.21 per cent to USD 82.57 a barrel on Tuesday.

The BSE benchmark jumped 1,240.90 points or 1.76 per cent to settle at 71,941.57 on Monday. The Nifty climbed 385 points or 1.80 per cent to 21,737.60.

Foreign Institutional Investors (FIIs) bought equities worth Rs 110.01 crore on Monday, according to exchange data.

The 30-share BSE Sensex fell by 801.67 points or 1.11 per cent to settle at 71,139.90. During the day, it plummeted 865.85 points or 1.20 per cent to 71,075.72.

The Nifty declined 215.50 points or 0.99 per cent to 21,522.10.

Among the Sensex firms, Bajaj Finance fell by 5.03 per cent after its December quarter earnings failed to cheer investors.

Titan, UltraTech Cement, Bajaj Finserv, Reliance Industries, ITC and NTPC were among the other major laggards.

Tata Motors, State Bank of India, Hindustan Unilever, Power Grid, Tech Mahindra and Tata Consultancy Services were the gainers.

"Selling intensified towards the fag end as investors further slashed their positions in key stocks ahead of the Budget while weakness in several Asian indices also contributed to the overall fall.

"With just one day left for the Budget, investors want to play it safe although there would not be any big-bang announcement by the government in this budget. Focus would rather shift to US Fed policy but indications are that it may maintain the status quo on interest rates, which could unsettle investors further," said Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd.

In the broader market, the BSE midcap gauge declined 0.53 per cent while smallcap index climbed 0.18 per cent.

Consumer durables declined 2.40 per cent, capital goods dipped 1.24 per cent, power (1.12 per cent), FMCG (1 per cent), utilities (0.92 per cent) and industrials (0.77 per cent).

Realty emerged as the only gainer.

In Asian markets, Tokyo settled in the positive territory while Seoul, Shanghai and Hong Kong ended lower.

European markets were trading with gains. The US markets ended higher on Monday.

Global oil benchmark Brent crude climbed 0.21 per cent to USD 82.57 a barrel on Tuesday.

The BSE benchmark jumped 1,240.90 points or 1.76 per cent to settle at 71,941.57 on Monday. The Nifty climbed 385 points or 1.80 per cent to 21,737.60.

Foreign Institutional Investors (FIIs) bought equities worth Rs 110.01 crore on Monday, according to exchange data.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- AvanceTechnologies

- 1.17 ( -4.88)

- 88887803

- Vodafone-Idea-L

- 10.73 ( 0.00)

- 41759699

- Alstone-Textiles

- 0.30 ( -3.23)

- 38604790

- Meesho-L

- 170.20 (+ 53.33)

- 33021643

- Spicejet-Ltd

- 33.88 ( -1.25)

- 28519832