Sensex Hits 80,000, Nifty at Record High

The BSE Sensex breached the 80,000 mark for the first time on Wednesday, driven by gains in banking and FMCG shares. Nifty also reached a new all-time high.

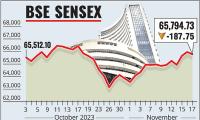

Photograph: Utpal Sarkar / ANI Photo.

Mumbai, Jul 3 (PTI) Benchmark BSE Sensex breached the historic 80,000 level intraday for the first time while Nifty raced more than 162 points to close at a fresh lifetime high on Wednesday following heavy buying in banking and FMCG shares amid firm global market trends.

The 30-share Sensex hit the historic 80,000 mark for the first time earlier in the day. It surged 632.85 points or 0.79 per cent to a record intraday high of 80,074.30. The index later closed near the 80,000 level at 79,986.80, up by 545.35 points or 0.69 per cent over the last close. As many as 24 Sensex shares closed with gains and six declined.

The BSE Sensex breached the 78,000 level on June 25 and 79,000 for the first time on June 27.

The Nifty climbed 162.65 points or 0.67 per cent to end at an all-time high of 24,286.50. During the day, it zoomed 183.4 points or 0.76 per cent to hit a fresh intraday record peak of 24,307.25. As many as 40 Nifty shares advanced, nine declined and one closed unchanged.

Among the Sensex pack, Adani Ports rose the most by 2.49 per cent. Kotak Mahindra Bank, HDFC Bank, ICICI Bank Axis Bank, IndusInd Bank, State Bank of India, Power Grid, JSW Steel, Bajaj Finance and Tata Steel were the biggest gainers.

On the other hand, Tata Consultancy Services, Titan, Reliance Industries, Tata Motors and Larsen & Toubro were the laggards.

"A broad-based rally was witnessed in the Indian market, boosted by large caps, with financials taking centre stage. With the drop in Indian banks' GNPAs to a 12-year low, the sector is anticipated to outperform in the near term," said Vinod Nair, Head of Research, Geojit Financial Services.

On the global front, the US Federal Reserve chief's commentary on inflation cooling down to 2 per cent by the end of CY25 was sentimentally positive. FOMC minutes later in the day might give hints on the start of the rate-cut cycle, Nair added.

"Markets edged higher, gaining over half a per cent, driven by favourable cues. Upbeat global markets and strength in banking majors led to a strong start, followed by a range-bound movement until the close," Ajit Mishra SVP, Research, Religare Broking Ltd, said.

In the broader market, the BSE midcap gauge jumped 0.86 per cent and the smallcap index climbed 0.86 per cent.

Among the indices, bankex rallied 1.75 per cent, financial services jumped 1.55 per cent. Telecommunication (1.44 per cent), services (1.18 per cent), industrials (1.09 per cent) and FMCG (0.81 per cent) were also among gainers.

A total of 2,355 stocks advanced while 1,566 declined and 100 remained unchanged.

In Asian markets, Seoul, Tokyo and Hong Kong settled in the positive territory while Shanghai ended lower. European markets were trading with gains. US markets ended higher on Tuesday.

The BSE benchmark declined 34.74 points or 0.04 per cent to settle at 79,441.45 in a volatile trade on Tuesday. During the day, it jumped 379.68 points or 0.47 per cent to a record peak of 79,855.87.

The Nifty declined by 18.10 points or 0.07 per cent to 24,123.85. Intra-day, it climbed 94.4 points or 0.39 per cent to hit a lifetime high of 24,236.35.

Global oil benchmark Brent crude climbed 0.09 per cent to USD 86.32 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 2,000.12 crore on Tuesday, according to exchange data.

The 30-share Sensex hit the historic 80,000 mark for the first time earlier in the day. It surged 632.85 points or 0.79 per cent to a record intraday high of 80,074.30. The index later closed near the 80,000 level at 79,986.80, up by 545.35 points or 0.69 per cent over the last close. As many as 24 Sensex shares closed with gains and six declined.

The BSE Sensex breached the 78,000 level on June 25 and 79,000 for the first time on June 27.

The Nifty climbed 162.65 points or 0.67 per cent to end at an all-time high of 24,286.50. During the day, it zoomed 183.4 points or 0.76 per cent to hit a fresh intraday record peak of 24,307.25. As many as 40 Nifty shares advanced, nine declined and one closed unchanged.

Among the Sensex pack, Adani Ports rose the most by 2.49 per cent. Kotak Mahindra Bank, HDFC Bank, ICICI Bank Axis Bank, IndusInd Bank, State Bank of India, Power Grid, JSW Steel, Bajaj Finance and Tata Steel were the biggest gainers.

On the other hand, Tata Consultancy Services, Titan, Reliance Industries, Tata Motors and Larsen & Toubro were the laggards.

"A broad-based rally was witnessed in the Indian market, boosted by large caps, with financials taking centre stage. With the drop in Indian banks' GNPAs to a 12-year low, the sector is anticipated to outperform in the near term," said Vinod Nair, Head of Research, Geojit Financial Services.

On the global front, the US Federal Reserve chief's commentary on inflation cooling down to 2 per cent by the end of CY25 was sentimentally positive. FOMC minutes later in the day might give hints on the start of the rate-cut cycle, Nair added.

"Markets edged higher, gaining over half a per cent, driven by favourable cues. Upbeat global markets and strength in banking majors led to a strong start, followed by a range-bound movement until the close," Ajit Mishra SVP, Research, Religare Broking Ltd, said.

In the broader market, the BSE midcap gauge jumped 0.86 per cent and the smallcap index climbed 0.86 per cent.

Among the indices, bankex rallied 1.75 per cent, financial services jumped 1.55 per cent. Telecommunication (1.44 per cent), services (1.18 per cent), industrials (1.09 per cent) and FMCG (0.81 per cent) were also among gainers.

A total of 2,355 stocks advanced while 1,566 declined and 100 remained unchanged.

In Asian markets, Seoul, Tokyo and Hong Kong settled in the positive territory while Shanghai ended lower. European markets were trading with gains. US markets ended higher on Tuesday.

The BSE benchmark declined 34.74 points or 0.04 per cent to settle at 79,441.45 in a volatile trade on Tuesday. During the day, it jumped 379.68 points or 0.47 per cent to a record peak of 79,855.87.

The Nifty declined by 18.10 points or 0.07 per cent to 24,123.85. Intra-day, it climbed 94.4 points or 0.39 per cent to hit a lifetime high of 24,236.35.

Global oil benchmark Brent crude climbed 0.09 per cent to USD 86.32 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 2,000.12 crore on Tuesday, according to exchange data.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea

- 11.36 ( -2.49)

- 94664837

- AvanceTechnologies

- 1.16 (+ 4.50)

- 34522155

- Sunshine-Capital

- 0.26 ( -3.70)

- 29015901

- Alstone-Textiles

- 0.27 ( -3.57)

- 28695959

- Mehai-Technology

- 1.65 ( -4.62)

- 28262795