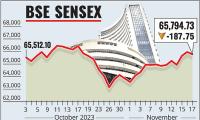

Sensex Hits New High on IT Rally: TCS, Infosys Drive Gains

Indian stock markets surge to record highs, led by strong IT performance from TCS and Infosys. Sensex climbs nearly 850 points, Nifty crosses 21,800. Read more.

Photograph: Utpal Sarkar / ANI Photo.

Mumbai, Jan 12 (PTI) Benchmark equity indices Sensex and Nifty surged over 1 per cent to hit their fresh all-time highs on Friday, driven by a stellar rally in IT stocks after TCS and Infosys reported better-than-expected financial results.

Besides, a strengthening rupee and hectic buying on tech, realty and oil counters amid a mixed trend in global markets further bolstered sentiment, traders said.

The 30-share BSE Sensex zoomed 847.27 points or 1.18 per cent to settle at a new closing high of 72,568.45. During the day, it jumped 999.78 points or 1.39 per cent to reach a new intra-day record of 72,720.96.

A total of 2,112 stocks advanced, while 1,742 declined and 88 remained unchanged on the BSE.

The Nifty climbed 247.35 points or 1.14 per cent to settle at a lifetime closing high of 21,894.55. During the day, it rallied 281.05 points or 1.29 per cent to reach its fresh intra-day record peak of 21,928.25.

On a weekly basis, the BSE benchmark jumped 542.3 points or 0.75 per cent, and the Nifty climbed 183.75 points or 0.84 per cent.

"Indian markets soared to new heights in a powerful rally, driven by IT heavyweights. Green shoots of recovery in the IT sector on the back of an improved outlook for BFSI in FY25 positively influenced market sentiments. The robust performance of PSU banking stocks is underscored by the inherent synergy between their loan portfolios and the prevailing business cycle.

"Noteworthy is the fact that this upward surge remained resilient amid mixed global cues on account of higher-than-expected US inflation and positive job data, which tempered expectations for an imminent rate cut by the US Fed," said Vinod Nair, Head of Research, Geojit Financial Services.

Infosys jumped nearly 8 per cent after the company's December quarter earnings came in line with market expectations.

"Infosys reported broadly in-line performance for the quarter. The revenue growth was above estimates; while EBIT margin was in line with expectation," according to a report by YES Securities.

A rally in Infosys also fueled optimism in other IT stocks.

Tata Consultancy Services climbed nearly 4 per cent after the largest software exporter reported an 8.2 per cent growth in net income for the December quarter at Rs 11,735 crore, driven by a massive growth in the home market that offset to a large extent the impact of a 3 per cent degrowth in the US market.

The other prominent gainers were Tech Mahindra, HCL Technologies, Wipro, State Bank of India and Larsen & Toubro, rising up to 4.73 per cent.

In contrast, Bajaj Finserv, Power Grid, UltraTech Cement and HDFC Bank were among the laggards.

IT majors Wipro and HCLTech will release their financial results later in the day.

The Industrial Production (IIP) and Consumer Price Index (CPI) inflation data will be released after market hours on Friday.

The BSE Information Technology index jumped 5.06 per cent, the most among the sectoral indices. Teck also gained 4.40 per cent.

In the broader market, the BSE smallcap gauge climbed 0.41 per cent, and midcap index rallied 0.36 per cent.

Among the indices, IT jumped 5.06 per cent, teck climbed 4.40 per cent, realty (1.93 per cent), oil & gas (1.71 per cent), energy (1.09 per cent) and telecommunication (0.77 per cent).

Utilities, auto and power were the laggards.

"Nifty ended at record levels and extended the winning streak for the fourth consecutive session on January 12. European markets were higher Friday as investors digested fresh UK economic data and looked ahead to a second US inflation report (PPI) this week. Oil surged amid escalating tensions in the Middle East," said Deepak Jasani, Head of Retail Research at HDFC Securities.

In Asian markets, Tokyo settled higher, while Seoul, Shanghai and Hong Kong ended lower.

European markets were trading in positive territory. The US markets ended mostly in the green on Thursday.

Global oil benchmark Brent crude jumped 2.49 per cent to USD 79.34 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 865 crore on Thursday, according to exchange data.

The rupee strengthened for the eighth consecutive session and settled with a gain of 11 paise at 82.90 (provisional) against the US dollar on Friday.

The BSE benchmark climbed 63.47 points or 0.09 per cent to settle at 71,721.18 on Thursday. The Nifty gained 28.50 points or 0.13 per cent to 21,647.20.

Besides, a strengthening rupee and hectic buying on tech, realty and oil counters amid a mixed trend in global markets further bolstered sentiment, traders said.

The 30-share BSE Sensex zoomed 847.27 points or 1.18 per cent to settle at a new closing high of 72,568.45. During the day, it jumped 999.78 points or 1.39 per cent to reach a new intra-day record of 72,720.96.

A total of 2,112 stocks advanced, while 1,742 declined and 88 remained unchanged on the BSE.

The Nifty climbed 247.35 points or 1.14 per cent to settle at a lifetime closing high of 21,894.55. During the day, it rallied 281.05 points or 1.29 per cent to reach its fresh intra-day record peak of 21,928.25.

On a weekly basis, the BSE benchmark jumped 542.3 points or 0.75 per cent, and the Nifty climbed 183.75 points or 0.84 per cent.

"Indian markets soared to new heights in a powerful rally, driven by IT heavyweights. Green shoots of recovery in the IT sector on the back of an improved outlook for BFSI in FY25 positively influenced market sentiments. The robust performance of PSU banking stocks is underscored by the inherent synergy between their loan portfolios and the prevailing business cycle.

"Noteworthy is the fact that this upward surge remained resilient amid mixed global cues on account of higher-than-expected US inflation and positive job data, which tempered expectations for an imminent rate cut by the US Fed," said Vinod Nair, Head of Research, Geojit Financial Services.

Infosys jumped nearly 8 per cent after the company's December quarter earnings came in line with market expectations.

"Infosys reported broadly in-line performance for the quarter. The revenue growth was above estimates; while EBIT margin was in line with expectation," according to a report by YES Securities.

A rally in Infosys also fueled optimism in other IT stocks.

Tata Consultancy Services climbed nearly 4 per cent after the largest software exporter reported an 8.2 per cent growth in net income for the December quarter at Rs 11,735 crore, driven by a massive growth in the home market that offset to a large extent the impact of a 3 per cent degrowth in the US market.

The other prominent gainers were Tech Mahindra, HCL Technologies, Wipro, State Bank of India and Larsen & Toubro, rising up to 4.73 per cent.

In contrast, Bajaj Finserv, Power Grid, UltraTech Cement and HDFC Bank were among the laggards.

IT majors Wipro and HCLTech will release their financial results later in the day.

The Industrial Production (IIP) and Consumer Price Index (CPI) inflation data will be released after market hours on Friday.

The BSE Information Technology index jumped 5.06 per cent, the most among the sectoral indices. Teck also gained 4.40 per cent.

In the broader market, the BSE smallcap gauge climbed 0.41 per cent, and midcap index rallied 0.36 per cent.

Among the indices, IT jumped 5.06 per cent, teck climbed 4.40 per cent, realty (1.93 per cent), oil & gas (1.71 per cent), energy (1.09 per cent) and telecommunication (0.77 per cent).

Utilities, auto and power were the laggards.

"Nifty ended at record levels and extended the winning streak for the fourth consecutive session on January 12. European markets were higher Friday as investors digested fresh UK economic data and looked ahead to a second US inflation report (PPI) this week. Oil surged amid escalating tensions in the Middle East," said Deepak Jasani, Head of Retail Research at HDFC Securities.

In Asian markets, Tokyo settled higher, while Seoul, Shanghai and Hong Kong ended lower.

European markets were trading in positive territory. The US markets ended mostly in the green on Thursday.

Global oil benchmark Brent crude jumped 2.49 per cent to USD 79.34 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 865 crore on Thursday, according to exchange data.

The rupee strengthened for the eighth consecutive session and settled with a gain of 11 paise at 82.90 (provisional) against the US dollar on Friday.

The BSE benchmark climbed 63.47 points or 0.09 per cent to settle at 71,721.18 on Thursday. The Nifty gained 28.50 points or 0.13 per cent to 21,647.20.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.25 (+ 4.85)

- 124593459

- Mangalam-Industrial

- 0.90 (+ 4.65)

- 43018654

- Welcure-Drugs-and

- 0.50 (+ 4.17)

- 39983710

- Alstone-Textiles

- 0.29 ( -3.33)

- 27516634

- Murae-Organisor

- 0.27 (+ 3.85)

- 26520405