EPFO Interest Rate Hiked to 8.25% - Highest in 3 Years

The Employees' Provident Fund Organisation (EPFO) has raised the interest rate on employee provident fund to 8.25% for FY24, marking the highest rate in three years. This decision comes ahead of general elections and is expected to benefit nearly 8 crore subscribers.

Illustration: Uttam Ghosh/Rediff.com

New Delhi, Feb 10 (PTI) Ahead of general elections, the interest rate paid on employee provident fund was on Saturday hiked to 8.25 per cent for fiscal year ending March 31, the highest in three years.

The central board of trustees of the Employees' Provident Fund Organisation (EPFO) recommended to the finance ministry for raising the interest rate for nearly 8 crore contributing subscribers, the labour ministry said in a statement.

This will be the highest rate of interest for EPF subscribers in the last three years. The previous high was in 2019-20 when 8.5 per cent interest was paid. The rate of payout was maintained at the same level in 2020-21 but in the following year it was cut to 8.1 per cent, the lowest in four decades. (EPF interest rate was 8 per cent in 1977-78).

The interest rate was marginally hiked to 8.15 per cent in 2022-23 (April 2022 to March 2023).

The recommendation for 2023-24 fiscal will now go to the finance ministry and once it agrees to it, the EPFO will credit the rate of interest to the EPF subscribers.

India will go to the polls in April-May to elect a new government.

According to the labour ministry statement, the decision to hike interest rate for 2023-24 was taken at the 235th meeting of the Central Board of Trustees (CBT) of EPFO on Saturday, under the chairmanship of Union Labour & Employment Minister Bhupender Yadav.

"The CBT recommended an annual rate of interest of 8.25 per cent to be credited on EPF accumulations in members' accounts for 2023-24. This interest rate will be officially notified in the government gazette after approval by the Ministry of Finance. Subsequently, EPFO will credit the approved rate of interest into its subscribers' accounts," it stated.

For FY24, the board recommended distribution of Rs 1,07,000 crore to EPF members' accounts on a total principal amount of Rs 13 lakh crore, which was Rs 91,151.66 crore and Rs 11.02 lakh crore, respectively in 2022-23.

Total income recommended for distribution is the highest on record, it said.

Compared with the previous financial year, there has been a significant growth, the statement said, adding that the income grew by more than 17.39 per cent, while the principal amount increased by 17.97 per cent.

This suggests a healthy financial performance and potentially strong returns for the members, it stated.

EPFO has a strong track record of distributing higher income to its members over the years with prudence.

The interest rate offered by EPFO tends to be higher compared to other investment avenues available to subscribers, it stated.

This indicates confidence in the credit profile of EPFO's investments, as well as its ability to provide attractive returns to its members, it stated.

In March 2020, EPFO had lowered the interest rate on provident fund deposits to a seven-year low of 8.5 per cent for 2019-20, from 8.65 per cent provided for 2018-19.

EPFO had provided 8.65 per cent interest rate to its subscribers in 2016-17 and 8.55 per cent in 2017-18. The rate of interest was slightly higher at 8.8 per cent in 2015-16.

The retirement fund body had given 8.75 per cent rate of interest in 2013-14 as well as 2014-15, higher than 8.5 per cent for 2012-13. The rate of interest was 8.25 per cent in 2011-12.

"CBT-EPFO decided to increase the rate of interest on the request of the employees representatives in the Board, pensioners' SEWA app and launch of industry geo tagging etc, it is a historic decision taken by the newly-constructed CBT-EPFO board," said S P Tiwari, National General Secretary, TUCC & Member, CBT-EPFO.

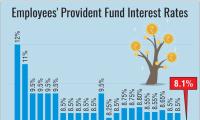

EPF Interest Rates Since 2010

2010-11 : 9.50%

2011-12 : 8.25%

2012-13 : 8.50%

2013-14 : 8.75%

2014-15 : 8.75%

2015-16 : 8.80%

2016-17 : 8.65%

2017-18 : 8.55%

2018-19 : 8.65%

2019-20 : 8.5%

2020-21 : 8.5%

2021-22 : 8.1%

2022-23 : 8.15%

2023-24 : 8.25% (recommended) PTI KKS ANZ

The central board of trustees of the Employees' Provident Fund Organisation (EPFO) recommended to the finance ministry for raising the interest rate for nearly 8 crore contributing subscribers, the labour ministry said in a statement.

This will be the highest rate of interest for EPF subscribers in the last three years. The previous high was in 2019-20 when 8.5 per cent interest was paid. The rate of payout was maintained at the same level in 2020-21 but in the following year it was cut to 8.1 per cent, the lowest in four decades. (EPF interest rate was 8 per cent in 1977-78).

The interest rate was marginally hiked to 8.15 per cent in 2022-23 (April 2022 to March 2023).

The recommendation for 2023-24 fiscal will now go to the finance ministry and once it agrees to it, the EPFO will credit the rate of interest to the EPF subscribers.

India will go to the polls in April-May to elect a new government.

According to the labour ministry statement, the decision to hike interest rate for 2023-24 was taken at the 235th meeting of the Central Board of Trustees (CBT) of EPFO on Saturday, under the chairmanship of Union Labour & Employment Minister Bhupender Yadav.

"The CBT recommended an annual rate of interest of 8.25 per cent to be credited on EPF accumulations in members' accounts for 2023-24. This interest rate will be officially notified in the government gazette after approval by the Ministry of Finance. Subsequently, EPFO will credit the approved rate of interest into its subscribers' accounts," it stated.

For FY24, the board recommended distribution of Rs 1,07,000 crore to EPF members' accounts on a total principal amount of Rs 13 lakh crore, which was Rs 91,151.66 crore and Rs 11.02 lakh crore, respectively in 2022-23.

Total income recommended for distribution is the highest on record, it said.

Compared with the previous financial year, there has been a significant growth, the statement said, adding that the income grew by more than 17.39 per cent, while the principal amount increased by 17.97 per cent.

This suggests a healthy financial performance and potentially strong returns for the members, it stated.

EPFO has a strong track record of distributing higher income to its members over the years with prudence.

The interest rate offered by EPFO tends to be higher compared to other investment avenues available to subscribers, it stated.

This indicates confidence in the credit profile of EPFO's investments, as well as its ability to provide attractive returns to its members, it stated.

In March 2020, EPFO had lowered the interest rate on provident fund deposits to a seven-year low of 8.5 per cent for 2019-20, from 8.65 per cent provided for 2018-19.

EPFO had provided 8.65 per cent interest rate to its subscribers in 2016-17 and 8.55 per cent in 2017-18. The rate of interest was slightly higher at 8.8 per cent in 2015-16.

The retirement fund body had given 8.75 per cent rate of interest in 2013-14 as well as 2014-15, higher than 8.5 per cent for 2012-13. The rate of interest was 8.25 per cent in 2011-12.

"CBT-EPFO decided to increase the rate of interest on the request of the employees representatives in the Board, pensioners' SEWA app and launch of industry geo tagging etc, it is a historic decision taken by the newly-constructed CBT-EPFO board," said S P Tiwari, National General Secretary, TUCC & Member, CBT-EPFO.

EPF Interest Rates Since 2010

2010-11 : 9.50%

2011-12 : 8.25%

2012-13 : 8.50%

2013-14 : 8.75%

2014-15 : 8.75%

2015-16 : 8.80%

2016-17 : 8.65%

2017-18 : 8.55%

2018-19 : 8.65%

2019-20 : 8.5%

2020-21 : 8.5%

2021-22 : 8.1%

2022-23 : 8.15%

2023-24 : 8.25% (recommended) PTI KKS ANZ

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005