IMF Doubts Pakistan's Repayment Capacity as Support Team Arrives

The IMF expresses serious doubts about Pakistan's ability to repay its debts, highlighting risks from delayed reforms and high public debt. A support team has arrived in Islamabad to discuss a fresh bailout package.

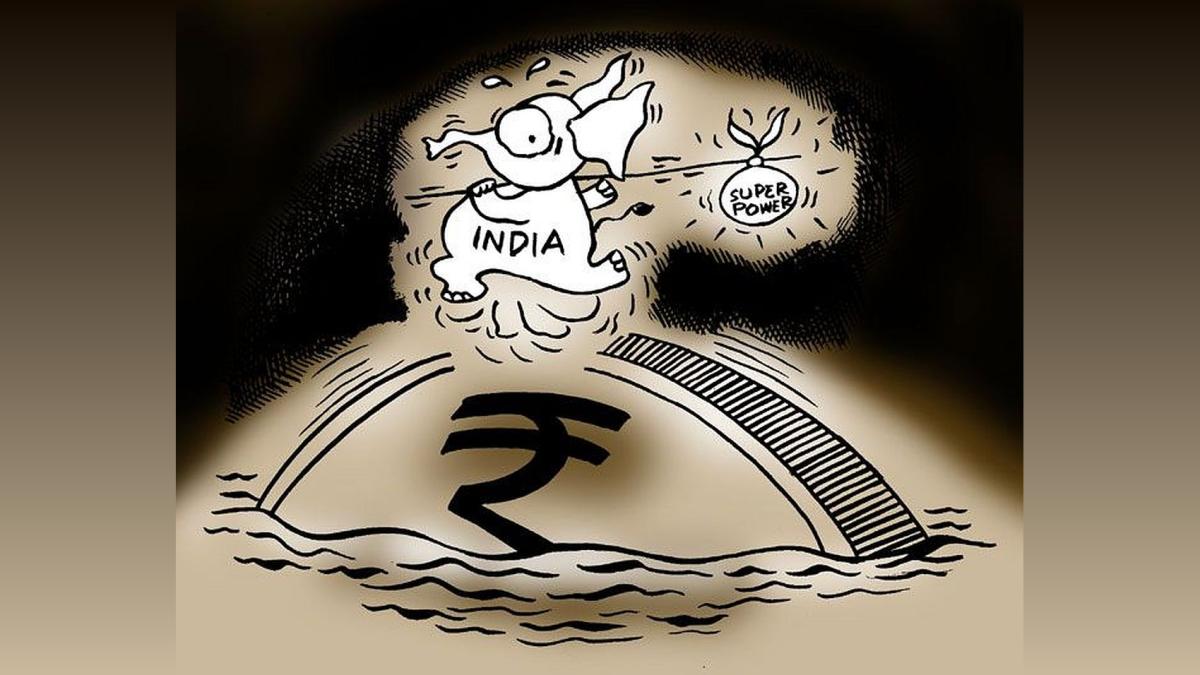

Illustration: Uttam Ghosh/Rediff.com

Islamabad, May 11 (PTI) The IMF has said that Pakistan faces major debt-repayment challenges and expressed serious doubts over the cash-strapped country's capacity to repay the global lender, according to a media report on Saturday.

The Washington-based bank's assessment of Pakistan's economy came as an IMF support team reached the country on Friday to hold talks with officials here after Islamabad requested a fresh bailout package under the Extended Fund Facility (EFF).

Pakistan's capacity to repay the fund is subject to significant risks and remains critically dependent on policy implementation and timely external financing, Geo News cited the Washington-based lender as saying in its staff report issued earlier this month on Pakistan.

Exceptionally high risks notably from delayed adoption of reforms, high public debt and gross financing needs, low gross reserves and the State Bank of Pakistan's (SBP) net FX derivative position, a decline in inflows, and sociopolitical factors could jeopardise policy implementation and erode repayment capacity and debt sustainability," read the report.

It further said that restoring external viability was critical to ensure Pakistan's capacity to repay the fund, and hinges on strong policy implementation, including, but not limited to, external asset accumulation and exchange rate flexibility.

Geopolitical instability is an additional source of risk even as uncertainty surrounding global financial conditions has declined somewhat since the last review, it added.

The global lender noted that the country needed gross financing worth USD 123 billion during the next five years, adding that Pakistan was expected to seek USD 21 billion in fiscal year 2024-25 and USD 23 billion in 2025-26.

The report further said the crisis-hit country was expected to seek USD 22 billion in 2026-27, USD 29 billion in 2027-28, and USD 28 billion in 2028-29.

According to sources privy to the matter, a support team of the global lender will discuss the first phase of the next long-term loan programme with the country's financial team.

The sources said the advance party had reached Pakistan for talks while the IMF mission would arrive on May 16.

The team will receive data from different departments and discuss the upcoming budget for the fiscal year 2025 (FY2025) with the Ministry of Finance officials.

The sources also revealed that the team would stay in Pakistan for over 10 days.

Pakistan sought the next bailout package in the range of USD 6 and USD 8 billion for the three years under the EEF with the possibility of augmentation through climate financing.

"Accelerating reforms now is more important than the size of the programme, which will be guided by the package of reform and balance of payments needs," an IMF statement had said earlier.

Meanwhile, Pakistan has decided to seek a rollover of around USD 12 billion debt from key allies like China in the 2024-25 fiscal year to meet a whopping USD 23 billion worth of gap in its external financing as the federal government aims to achieve budget targets before the expected arrival of the IMF team to the country.

According to the Finance Ministry insiders, USD 5 billion from Saudi Arabia, USD 3 billion from the UAE and USD 4 billion from China will be rolled over, adding that the estimate of further new financing from China would also be included in the next financial year's budget.

Pakistan will receive more than USD 1 billion from the IMF under the fresh loan programme while new financing from the World Bank and Asian Development Bank has also been included in the estimated budget.

According to the Finance Ministry sources, new loan programme agreements will be made with financial institutions. The federal government aims to achieve budget targets before the anticipated arrival of the IMF review mission in Pakistan, the report said.

Negotiations for a new loan programme with the global lender are expected to commence in mid-May ahead of the budget to be presented in June.

Pakistan narrowly averted default last summer and the economy has stabilised after the completion of the last IMF programme with inflation coming down to around 17 per cent in April from a record high of 38 per cent last May.

The country is still dealing with a high fiscal shortfall and while the external account deficit has been controlled through import control mechanisms, it has come at the expense of stagnating growth, which is expected to be around 2 per cent this year compared to negative growth last year.

The Washington-based bank's assessment of Pakistan's economy came as an IMF support team reached the country on Friday to hold talks with officials here after Islamabad requested a fresh bailout package under the Extended Fund Facility (EFF).

Pakistan's capacity to repay the fund is subject to significant risks and remains critically dependent on policy implementation and timely external financing, Geo News cited the Washington-based lender as saying in its staff report issued earlier this month on Pakistan.

Exceptionally high risks notably from delayed adoption of reforms, high public debt and gross financing needs, low gross reserves and the State Bank of Pakistan's (SBP) net FX derivative position, a decline in inflows, and sociopolitical factors could jeopardise policy implementation and erode repayment capacity and debt sustainability," read the report.

It further said that restoring external viability was critical to ensure Pakistan's capacity to repay the fund, and hinges on strong policy implementation, including, but not limited to, external asset accumulation and exchange rate flexibility.

Geopolitical instability is an additional source of risk even as uncertainty surrounding global financial conditions has declined somewhat since the last review, it added.

The global lender noted that the country needed gross financing worth USD 123 billion during the next five years, adding that Pakistan was expected to seek USD 21 billion in fiscal year 2024-25 and USD 23 billion in 2025-26.

The report further said the crisis-hit country was expected to seek USD 22 billion in 2026-27, USD 29 billion in 2027-28, and USD 28 billion in 2028-29.

According to sources privy to the matter, a support team of the global lender will discuss the first phase of the next long-term loan programme with the country's financial team.

The sources said the advance party had reached Pakistan for talks while the IMF mission would arrive on May 16.

The team will receive data from different departments and discuss the upcoming budget for the fiscal year 2025 (FY2025) with the Ministry of Finance officials.

The sources also revealed that the team would stay in Pakistan for over 10 days.

Pakistan sought the next bailout package in the range of USD 6 and USD 8 billion for the three years under the EEF with the possibility of augmentation through climate financing.

"Accelerating reforms now is more important than the size of the programme, which will be guided by the package of reform and balance of payments needs," an IMF statement had said earlier.

Meanwhile, Pakistan has decided to seek a rollover of around USD 12 billion debt from key allies like China in the 2024-25 fiscal year to meet a whopping USD 23 billion worth of gap in its external financing as the federal government aims to achieve budget targets before the expected arrival of the IMF team to the country.

According to the Finance Ministry insiders, USD 5 billion from Saudi Arabia, USD 3 billion from the UAE and USD 4 billion from China will be rolled over, adding that the estimate of further new financing from China would also be included in the next financial year's budget.

Pakistan will receive more than USD 1 billion from the IMF under the fresh loan programme while new financing from the World Bank and Asian Development Bank has also been included in the estimated budget.

According to the Finance Ministry sources, new loan programme agreements will be made with financial institutions. The federal government aims to achieve budget targets before the anticipated arrival of the IMF review mission in Pakistan, the report said.

Negotiations for a new loan programme with the global lender are expected to commence in mid-May ahead of the budget to be presented in June.

Pakistan narrowly averted default last summer and the economy has stabilised after the completion of the last IMF programme with inflation coming down to around 17 per cent in April from a record high of 38 per cent last May.

The country is still dealing with a high fiscal shortfall and while the external account deficit has been controlled through import control mechanisms, it has come at the expense of stagnating growth, which is expected to be around 2 per cent this year compared to negative growth last year.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005