IMF Praises Sri Lanka's Recovery, Calls for More Revenue

The IMF commends Sri Lanka's economic recovery under its bailout program, highlighting positive outcomes like GDP growth and inflation control. However, it emphasizes the need for further revenue generation and spending cuts.

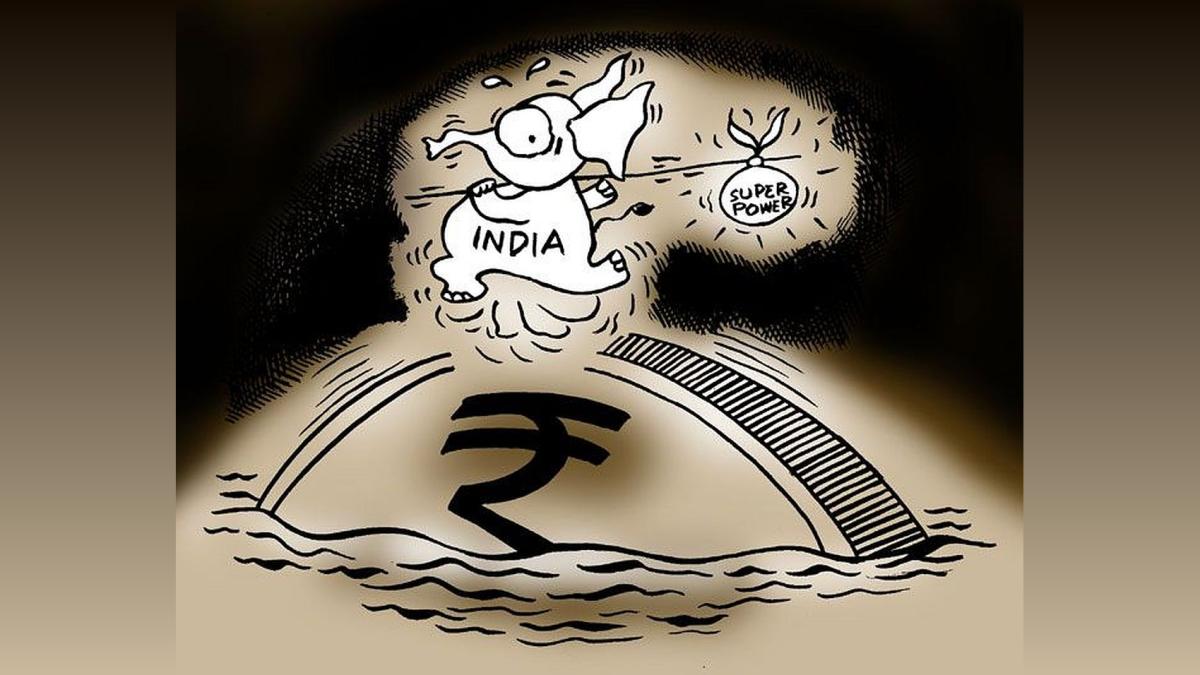

Illustration: Uttam Ghosh/Rediff.com

Colombo, Aug 2 (PTI) Sri Lanka's economic reform programme under the IMF bailout has yielded good results, the global crisis lender said on Friday at the end of its latest mission to the cash-strapped island nation.

The International Monetary Fund (IMF) mission was here from July 25 to discuss macroeconomic developments and progress in implementing economic and financial policies by the government.

In mid-April 2022, Sri Lanka declared its first-ever sovereign default since gaining independence from Britain in 1948. The Washington-headquartered global lender had made external debt restructuring conditional to the USD 2.9 billion bailout package, of which the third tranche was released in mid-June.

IMF mission chief Peter Breuer said: The economic reform programme implemented by the Sri Lankan authorities is yielding commendable outcomes. The recovery continues with real GDP posting three consecutive quarters of expansion, and growth accelerating to 5.3 per cent year-on-year in the first quarter of 2024.

Inflation remains contained below the Central Bank of Sri Lanka's (CBSL) 5 per cent target and domestic borrowing rates have declined. Gross international reserves increased by USD 1.2 billion during the first half of 2024 and reached USD 5.6 billion.

Fiscal revenue collections increased during the same period. "Going forward, these improvements need to translate into better living conditions for all of Sri Lanka's people, Breuer added.

The IMF said the timing of the third review will be discussed with the government after the presidential election on September 21.

The IMF mission also insisted on further revenue raising and spending cuts. The IMF advocates the relaxation of import restrictions on motor vehicles as a measure of revenue mobilisation in 2025.

The IMF has commended new pieces of legislation implemented for economic recovery.

The recent parliamentary approval of two key pieces of legislation the Public Financial Management Act and the Public Debt Management Act is a milestone that will improve fiscal discipline and prudent debt management, bolstering transparency and accountability.

Developing a holistic debt management strategy and establishing a well-structured and integrated Public Debt Management Office will help lower the government's financing risks, it said.

The recent amendments to the Banking Act and the related implementing regulations will help safeguard financial stability. To allow the financial sector to contribute to economic growth, the authorities need to ensure the banking sector is adequately capitalised.

The recently formulated National Anti-corruption Agenda, building on the authorities' earlier governance action plan, is a welcome step, the IMF said.

The authorities have made commendable progress with putting debt on a path towards sustainability. The execution of the domestic debt restructuring and finalising the agreements with the Official Creditor Committee and China EXIM Bank are major milestones.

"We encourage a swift resolution of the remaining steps to achieve debt sustainability and regain investor confidence. We will continue to support Sri Lanka's ongoing debt restructuring efforts," the IMF said.

The International Monetary Fund (IMF) mission was here from July 25 to discuss macroeconomic developments and progress in implementing economic and financial policies by the government.

In mid-April 2022, Sri Lanka declared its first-ever sovereign default since gaining independence from Britain in 1948. The Washington-headquartered global lender had made external debt restructuring conditional to the USD 2.9 billion bailout package, of which the third tranche was released in mid-June.

IMF mission chief Peter Breuer said: The economic reform programme implemented by the Sri Lankan authorities is yielding commendable outcomes. The recovery continues with real GDP posting three consecutive quarters of expansion, and growth accelerating to 5.3 per cent year-on-year in the first quarter of 2024.

Inflation remains contained below the Central Bank of Sri Lanka's (CBSL) 5 per cent target and domestic borrowing rates have declined. Gross international reserves increased by USD 1.2 billion during the first half of 2024 and reached USD 5.6 billion.

Fiscal revenue collections increased during the same period. "Going forward, these improvements need to translate into better living conditions for all of Sri Lanka's people, Breuer added.

The IMF said the timing of the third review will be discussed with the government after the presidential election on September 21.

The IMF mission also insisted on further revenue raising and spending cuts. The IMF advocates the relaxation of import restrictions on motor vehicles as a measure of revenue mobilisation in 2025.

The IMF has commended new pieces of legislation implemented for economic recovery.

The recent parliamentary approval of two key pieces of legislation the Public Financial Management Act and the Public Debt Management Act is a milestone that will improve fiscal discipline and prudent debt management, bolstering transparency and accountability.

Developing a holistic debt management strategy and establishing a well-structured and integrated Public Debt Management Office will help lower the government's financing risks, it said.

The recent amendments to the Banking Act and the related implementing regulations will help safeguard financial stability. To allow the financial sector to contribute to economic growth, the authorities need to ensure the banking sector is adequately capitalised.

The recently formulated National Anti-corruption Agenda, building on the authorities' earlier governance action plan, is a welcome step, the IMF said.

The authorities have made commendable progress with putting debt on a path towards sustainability. The execution of the domestic debt restructuring and finalising the agreements with the Official Creditor Committee and China EXIM Bank are major milestones.

"We encourage a swift resolution of the remaining steps to achieve debt sustainability and regain investor confidence. We will continue to support Sri Lanka's ongoing debt restructuring efforts," the IMF said.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.65 (+ 3.56)

- 106772451

- Alstone-Textiles

- 0.28 ( -3.45)

- 44187760

- Mangalam-Industrial

- 0.88 ( -2.22)

- 39177573

- Sunshine-Capital

- 0.27 (+ 3.85)

- 35956340

- GMR-Airports

- 104.40 (+ 6.37)

- 30453005