ITC Consolidates Oberoi, Leela Stakes Ahead of Hotel Demerger

By Rediff Money Desk, New Delhi Dec 18, 2024 20:06

ITC Ltd acquires shares in Oberoi and Leela hotel chains, increasing its stake ahead of the demerger of its hotels business into a separate entity in January 2025.

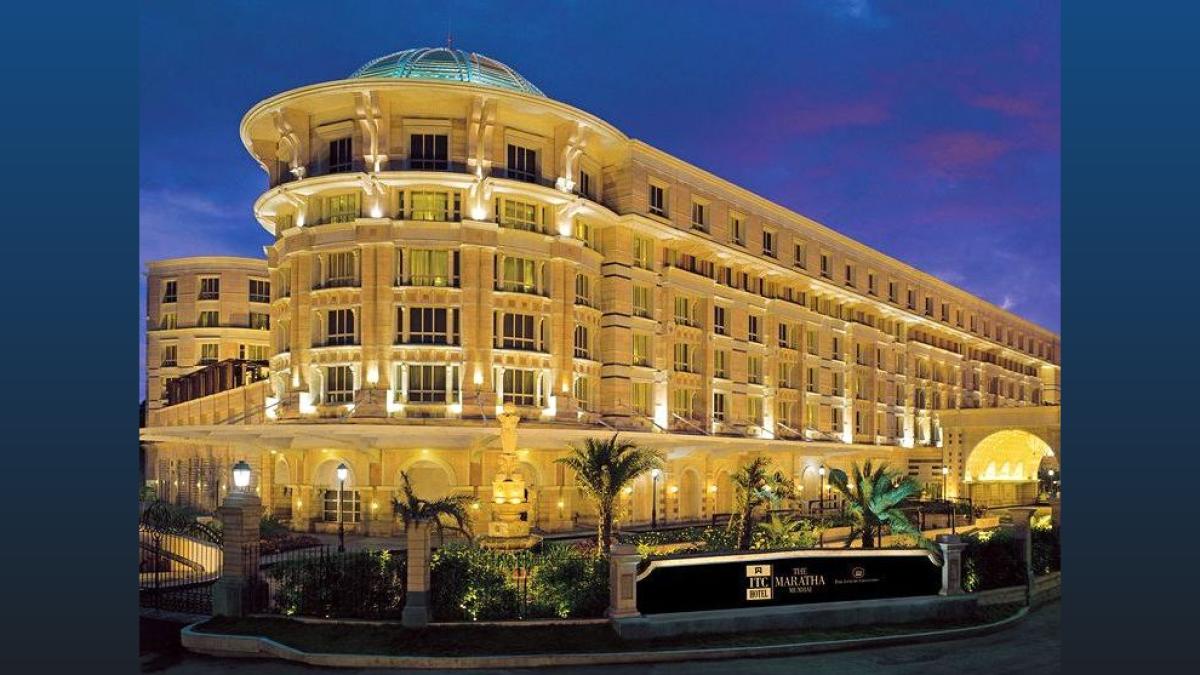

Photograph: Kind courtesy, ITC Hotels

New Delhi, Dec 18 (PTI) ITC Ltd, which is demerging its hotels business from January 2025, on Wednesday said it has acquired shareholding of rival hospitality chains Oberoi and Leela from its wholly-owned arm, Russell Credit Ltd.

"The company today acquired 2.44 per cent of the share capital (comprising 1.52 crore equity shares of Rs 2 each) of EIH and 0.53 per cent of the share capital (comprising 34.60 lakh equity shares of Rs 2 each) of HLV from RCL," ITC said in a regulatory filing.

Post such acquisition, ITC's shareholding in EIH and HLV aggregates to 16.13 per cent and 8.11 per cent, of their paid-up share capital, respectively, it added.

"The acquisition of shares was carried out at book value in the books of RCL," it said.

The board of ITC had on October 24 approved the consolidation of the shareholding of EIH and HLV under the company.

EIH owns and manages premium luxury hotels and cruisers under the Oberoi' and Trident' brands, while HLV Ltd owns and operates The Leela Mumbai.

Besides, in a separate filing, ITC informed that the company and ITC Hotels Limited (ITCHL) have mutually agreed to fix January 6, 2025 as the record date for the purposes of determining the shareholders of the company to whom equity shares of ITCHL would be allotted.

On Tuesday, Kolkata-headquartered ITC said all conditions for the demerger of its hotel business are "fulfilled" and the scheme would be effective from January 1, 2025.

The conglomerate has already received regulatory approvals, including from the National Company Law Tribunal (NCLT) on October 4, sanctioning the scheme between ITC and ITC Hotels.

The shareholders of ITC had already approved the demerger of ITC Hotels into a separate entity.

This will create a new wholly-owned subsidiary, ITC Hotels Ltd, to handle its hotels and hospitality business.

Under the scheme of demerger, ITC Hotels will issue equity shares directly to the shareholders of ITC in a manner that about 60 per cent stake is held directly by ITC shareholders proportionate to their shareholding in ITC and the remaining 40 per cent stake to continue with ITC, it said.

As per the schemes, investments in hospitality entities forming part of the hotel business -- Bay Islands Hotels Ltd, Fortune Park Hotels Ltd, Landbase India Ltd, Srinivasa Resorts Ltd, WelcomHotels Lanka Pvt Ltd, Gujarat Hotels Ltd, International Travel House Ltd and Maharaja Heritage Resorts Ltd -- will be transferred to ITC Hotels.

Launched in 1975, ITC Hotels, India's premier chain of luxury hotels, has over 140 hotels across 90-plus locations.

Shares of ITC Ltd settled at Rs 470.65 apiece on the BSE on Wednesday, up 0.17 per cent from the previous close.

"The company today acquired 2.44 per cent of the share capital (comprising 1.52 crore equity shares of Rs 2 each) of EIH and 0.53 per cent of the share capital (comprising 34.60 lakh equity shares of Rs 2 each) of HLV from RCL," ITC said in a regulatory filing.

Post such acquisition, ITC's shareholding in EIH and HLV aggregates to 16.13 per cent and 8.11 per cent, of their paid-up share capital, respectively, it added.

"The acquisition of shares was carried out at book value in the books of RCL," it said.

The board of ITC had on October 24 approved the consolidation of the shareholding of EIH and HLV under the company.

EIH owns and manages premium luxury hotels and cruisers under the Oberoi' and Trident' brands, while HLV Ltd owns and operates The Leela Mumbai.

Besides, in a separate filing, ITC informed that the company and ITC Hotels Limited (ITCHL) have mutually agreed to fix January 6, 2025 as the record date for the purposes of determining the shareholders of the company to whom equity shares of ITCHL would be allotted.

On Tuesday, Kolkata-headquartered ITC said all conditions for the demerger of its hotel business are "fulfilled" and the scheme would be effective from January 1, 2025.

The conglomerate has already received regulatory approvals, including from the National Company Law Tribunal (NCLT) on October 4, sanctioning the scheme between ITC and ITC Hotels.

The shareholders of ITC had already approved the demerger of ITC Hotels into a separate entity.

This will create a new wholly-owned subsidiary, ITC Hotels Ltd, to handle its hotels and hospitality business.

Under the scheme of demerger, ITC Hotels will issue equity shares directly to the shareholders of ITC in a manner that about 60 per cent stake is held directly by ITC shareholders proportionate to their shareholding in ITC and the remaining 40 per cent stake to continue with ITC, it said.

As per the schemes, investments in hospitality entities forming part of the hotel business -- Bay Islands Hotels Ltd, Fortune Park Hotels Ltd, Landbase India Ltd, Srinivasa Resorts Ltd, WelcomHotels Lanka Pvt Ltd, Gujarat Hotels Ltd, International Travel House Ltd and Maharaja Heritage Resorts Ltd -- will be transferred to ITC Hotels.

Launched in 1975, ITC Hotels, India's premier chain of luxury hotels, has over 140 hotels across 90-plus locations.

Shares of ITC Ltd settled at Rs 470.65 apiece on the BSE on Wednesday, up 0.17 per cent from the previous close.

Source: PTI

Read More On:

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Srestha Finvest

- 0.86 ( -4.44)

- 31999252

- Vodafone Idea L

- 7.46 (+ 0.81)

- 24575648

- Franklin Industries

- 3.00 ( -4.76)

- 20855926

- Mishtann Foods L

- 7.44 ( -9.93)

- 19977342

- Standard Capital

- 1.03 (+ 0.98)

- 15337248

MORE NEWS

Silver Futures Surge: Rs 1,064 Jump to Rs...

Silver prices in India jumped by Rs 1,064 to Rs 89,456 per kg on Monday, driven by...

PVR INOX Restructures Media Biz, Appoints Shalu...

PVR INOX announces restructuring of its Rs 600 crore media business, appointing Shalu...

West Bengal's Fiscal Imbalance: Revenue...

West Bengal's revenue expenditure surged in H1 FY25, while capital spending lagged,...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.