Motilal Oswal Small-Cap Fund Raises Rs 1,350 Cr in NFO

Motilal Oswal Asset Management Company's small-cap fund has garnered over Rs 1,350 crore during its NFO period, making it the highest ever collection for any active small-cap fund NFO in India.

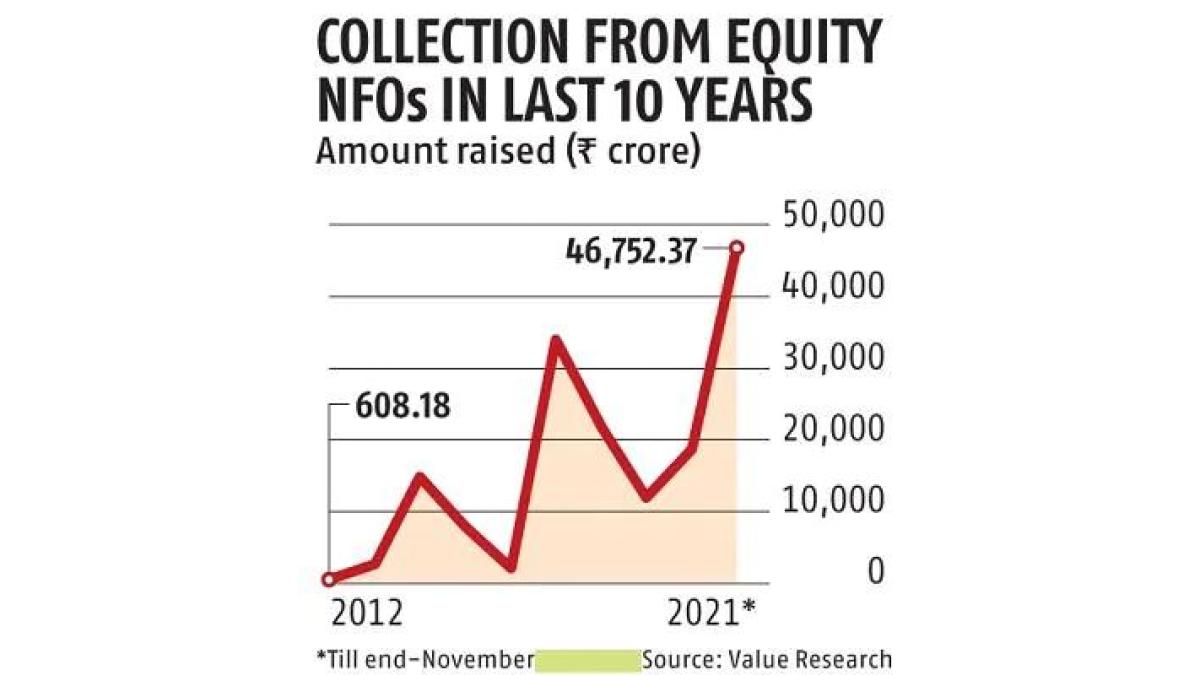

Illustration: Dominic Xavier/Rediff.com

New Delhi, Dec 22 (PTI) Motilal Oswal Asset Management Company (MOAMC) on Friday said it has mobilised over Rs 1,350 crore during the New Fund Offer (NFO) period of its small cap fund.

The asset management firm said it was the highest-ever collection for any small-cap active fund NFO in India.

Motilal Oswal small-cap fund, an open-ended equity scheme, was opened from December 5-19. It aims to maintain a well-balanced portfolio with a minimum of 65 per cent exposure to small-cap stock.

"The participation from retail investors has been quite notable, with over 1.5 lakh investors with an average ticket size of Rs 85,000 subscribing to the NFO. The fund has also seen SIP registrations of over 15 crore across 24,000 investors," the asset management firm said in a statement.

The firm said it received investments from over 50 Indian cities for its active fund NFO launched after a gap of four years.

Over the years, small-caps index has created long-term wealth for investors, compounding returns by19.32 per cent, 20.34 per cent and 22.06 per cent over the last 15, 10 and 5 years respectively.

The asset management firm said it was the highest-ever collection for any small-cap active fund NFO in India.

Motilal Oswal small-cap fund, an open-ended equity scheme, was opened from December 5-19. It aims to maintain a well-balanced portfolio with a minimum of 65 per cent exposure to small-cap stock.

"The participation from retail investors has been quite notable, with over 1.5 lakh investors with an average ticket size of Rs 85,000 subscribing to the NFO. The fund has also seen SIP registrations of over 15 crore across 24,000 investors," the asset management firm said in a statement.

The firm said it received investments from over 50 Indian cities for its active fund NFO launched after a gap of four years.

Over the years, small-caps index has created long-term wealth for investors, compounding returns by19.32 per cent, 20.34 per cent and 22.06 per cent over the last 15, 10 and 5 years respectively.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- Vodafone-Idea-L

- 11.25 (+ 4.85)

- 124593459

- Mangalam-Industrial

- 0.90 (+ 4.65)

- 43018654

- Welcure-Drugs-and

- 0.50 (+ 4.17)

- 39983710

- Alstone-Textiles

- 0.29 ( -3.33)

- 27516634

- Murae-Organisor

- 0.27 (+ 3.85)

- 26520405