Stock Market Crash: Investors Lose Rs 15.32 Lakh Crore

By Rediff Money Desk, New Delhi Aug 05, 2024 18:16

Indian stock market plunges, wiping out Rs 15.32 lakh crore in investor wealth due to global market turmoil, recession fears, and rising interest rates.

New Delhi, Aug 5 (PTI) Stock market investors lost a whopping Rs 15.32 lakh crore on Monday following a crash in Indian equities triggered by a sharp plunge in Japanese and other global markets.

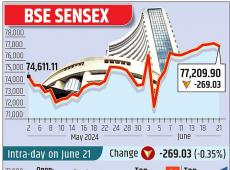

The 30-share BSE benchmark plummeted 2,222.55 points or 2.74 per cent to settle at over a month's low of 78,759.40, marking its worst single-day retreat since June 4, 2024. During the day, it tanked 2,686.09 points or 3.31 per cent to 78,295.86.

Following the sharp decline in equities, the market capitalisation of BSE-listed firms dropped by Rs 15,32,796.1 crore to Rs 4,41,84,150.03 crore (USD 5.27 trillion).

"Domestic equity indices came under the grip of global markets carnage as a host of external factors like recession fears in the US on the back of weak jobs data, interest rate hike in Japan leading to impact on Yen-carry trade and a raging Middle East conflict triggered massive sell-off across the board," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong settled sharply lower.

Japan's benchmark stock index plunged 12.4 per cent on Monday, compounding a global market rout set off by investor concerns that the US economy could be headed for recession.

A report on Friday showing hiring by US employers slowed last month by much more than expected convulsed financial markets, vanquishing the euphoria that had taken the Nikkei 225 to all-time highs of over 42,000 in recent weeks.

On Monday, the Nikkei closed down 4,451.28 points at 31,458.42. It had dropped 5.8 per cent on Friday, making this its worst two-day decline ever. Its worst single-day rout was a plunge of 3,836 points, or 14.9 per cent, on October 19, 1987, a global markets crash that was dubbed Black Monday but proved to be only a temporary setback despite fears it might have augured a worldwide downturn.

"The global market is reeling as bears enter with a cocktail of bad news. The fear of a reverse Yen carry trade, following an interest rate hike in Japan, was the initial catalyst. This was compounded by fears of a recession in the USA after extremely poor jobs data, which spooked market sentiment," said Santosh Meena, Head of Research, Swastika Investmart Ltd.

Indian equity markets are witnessing signs of the first meaningful correction in global markets after an extended bull run, he added.

European markets were also trading with deep cuts. The US markets ended significantly lower on Friday.

"Equity markets globally were jittery with Nikkei, Taiwan, and Kopsi down 14%/9%/9%. Following its global peers, Nifty opened gap down and corrected more than 800 points during the day. Going forward, we expect volatility to continue ahead of RBI Policy and multiple global headwinds, including the unwinding of Yen carry trades, recession fears in the US, and escalating tensions in the Middle East..

"US slowdown is a bigger concern and sooner or later US Fed will bite the bullet of interest rate cuts which should provide relief in the current environment," Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services Ltd, said.

From the Sensex pack, Tata Motors slumped over 7 per cent. Adani Ports, Tata Steel, SBI, Power Grid, Maruti and JSW Steel were the other big laggards.

However, Hindustan Unilever and Nestle ended in positive territory.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 3,310 crore on Friday, according to exchange data.

In the broader market, the BSE smallcap gauge dropped 4.21 per cent and midcap index plummeted 3.60 per cent.

All indices ended lower. Services index nosedived 4.56 per cent, utilities tanked 4.30 per cent, realty (4.25 per cent), capital goods (4.13 per cent), industrials (4.08 per cent), power (3.91 per cent), oil & gas (3.88 per cent) and commodities (3.82 per cent).

A total of 3,414 stocks declined while 664 advanced and 111 remained unchanged on the BSE.

The 30-share BSE benchmark plummeted 2,222.55 points or 2.74 per cent to settle at over a month's low of 78,759.40, marking its worst single-day retreat since June 4, 2024. During the day, it tanked 2,686.09 points or 3.31 per cent to 78,295.86.

Following the sharp decline in equities, the market capitalisation of BSE-listed firms dropped by Rs 15,32,796.1 crore to Rs 4,41,84,150.03 crore (USD 5.27 trillion).

"Domestic equity indices came under the grip of global markets carnage as a host of external factors like recession fears in the US on the back of weak jobs data, interest rate hike in Japan leading to impact on Yen-carry trade and a raging Middle East conflict triggered massive sell-off across the board," Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong settled sharply lower.

Japan's benchmark stock index plunged 12.4 per cent on Monday, compounding a global market rout set off by investor concerns that the US economy could be headed for recession.

A report on Friday showing hiring by US employers slowed last month by much more than expected convulsed financial markets, vanquishing the euphoria that had taken the Nikkei 225 to all-time highs of over 42,000 in recent weeks.

On Monday, the Nikkei closed down 4,451.28 points at 31,458.42. It had dropped 5.8 per cent on Friday, making this its worst two-day decline ever. Its worst single-day rout was a plunge of 3,836 points, or 14.9 per cent, on October 19, 1987, a global markets crash that was dubbed Black Monday but proved to be only a temporary setback despite fears it might have augured a worldwide downturn.

"The global market is reeling as bears enter with a cocktail of bad news. The fear of a reverse Yen carry trade, following an interest rate hike in Japan, was the initial catalyst. This was compounded by fears of a recession in the USA after extremely poor jobs data, which spooked market sentiment," said Santosh Meena, Head of Research, Swastika Investmart Ltd.

Indian equity markets are witnessing signs of the first meaningful correction in global markets after an extended bull run, he added.

European markets were also trading with deep cuts. The US markets ended significantly lower on Friday.

"Equity markets globally were jittery with Nikkei, Taiwan, and Kopsi down 14%/9%/9%. Following its global peers, Nifty opened gap down and corrected more than 800 points during the day. Going forward, we expect volatility to continue ahead of RBI Policy and multiple global headwinds, including the unwinding of Yen carry trades, recession fears in the US, and escalating tensions in the Middle East..

"US slowdown is a bigger concern and sooner or later US Fed will bite the bullet of interest rate cuts which should provide relief in the current environment," Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services Ltd, said.

From the Sensex pack, Tata Motors slumped over 7 per cent. Adani Ports, Tata Steel, SBI, Power Grid, Maruti and JSW Steel were the other big laggards.

However, Hindustan Unilever and Nestle ended in positive territory.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 3,310 crore on Friday, according to exchange data.

In the broader market, the BSE smallcap gauge dropped 4.21 per cent and midcap index plummeted 3.60 per cent.

All indices ended lower. Services index nosedived 4.56 per cent, utilities tanked 4.30 per cent, realty (4.25 per cent), capital goods (4.13 per cent), industrials (4.08 per cent), power (3.91 per cent), oil & gas (3.88 per cent) and commodities (3.82 per cent).

A total of 3,414 stocks declined while 664 advanced and 111 remained unchanged on the BSE.

Source: PTI

DISCLAIMER - This article is from a syndicated feed. The original source is responsible for accuracy, views & content ownership. Views expressed may not reflect those of rediff.com India Limited.

You May Like To Read

TODAY'S MOST TRADED COMPANIES

- Company Name

- Price

- Volume

- GTL Infrastructure

- 2.75 ( -4.84)

- 91787188

- YES Bank Ltd.

- 23.54 ( -7.50)

- 56012274

- Suzlon Energy Ltd.

- 67.91 ( -4.94)

- 33571450

- Vodafone Idea L

- 15.36 ( -4.66)

- 29911289

- Srestha Finvest

- 2.15 ( -4.87)

- 24478182

MORE NEWS

BSE Sensex Next 30 Index Launched by Asia Index

Asia Index launches BSE Sensex Next 30, tracking performance of top companies from BSE...

Niti Aayog: Deepening Corporate Bond Markets

Niti Aayog is working on proposals to deepen the corporate bond market in India, aiming...

Sebi mandates yield-to-call valuation for AT-1...

Sebi directs mutual funds to value AT-1 bonds based on yield-to-call, following NFRA's...

© 2024 Rediff.com India Limited. All rights reserved.

© 2024 Rediff.com India Limited. All rights reserved.