BSE | NSE

Subex Ltd.

|

532348 SUBEXLTD Group (A) 25 Nov,10:42

23.33

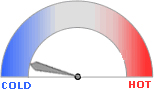

0.46 (2.01%) HOW HOT IS THIS STOCK?  Last 15 days data © Rediff.com Add to Watchlist

|

Refresh

Day

Wk

Mn

6Mn

Yr

|

| Volume | Prev close | Day's H/L (Rs.) | 52wk H/L (Rs.) | Mkt Cap (Rs. Cr) | |

| 86,480 | 22.87 | 23.46 - 23.22 | 45.80 - 21.92 | 1,311.15 |

Zoom

Zoom