IL&FS Investment Managers Ltd.

|

511208 IVC Group (B) 28 Mar,15:43

8.91

-0.05 (-0.56%)

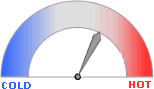

HOW HOT IS THIS STOCK?

Last 15 days data © Rediff.com Add to Watchlist

|

BSE | NSE

ZoomRefresh ZoomRefreshDay

Wk

Mn

6Mn

Yr

|